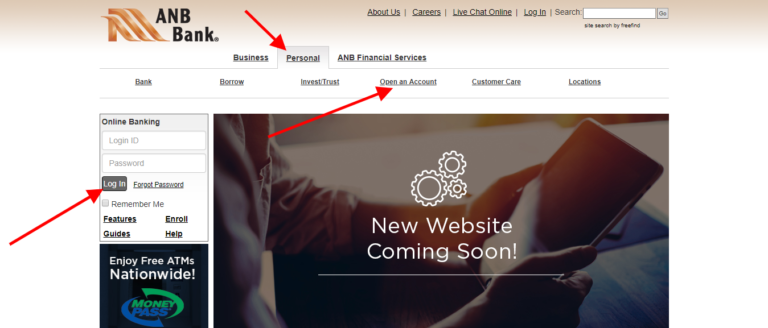

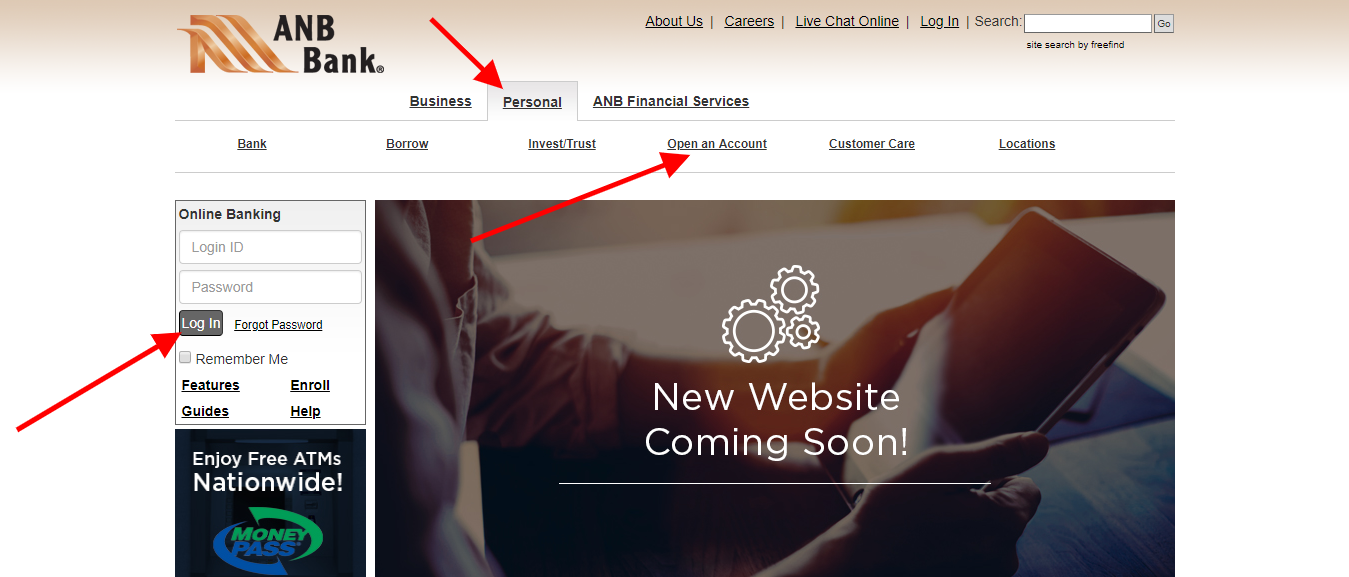

You will find the log in to ANB Corporation, by log on to their website https://www.anbbank.com/Personal/index.html – The log in box is in the upper left corner of the site. Enter your login id, password and login to your account with ANB bank.

If you would like to register an account to be able to use the online banking services of ANB bank, use the link mentioned above, then click on ENROLL which is located in the left corner upper side below the login box. Fill the necessary data, and submit for approval.

For opening account with ANB bank, you can do the process online by clicking on open an account, which is located above the login box as per the following screenshot. Enter the necessary data and submit for approval.

About ANB bANK

ANB Bank is known by American National Bank of Cheyenne Inc, ANB Bank, Sturm Financial Group, and Sturm Financial Group Inc. ANB Bank is a major, independently owned community bank with more than 35 banking centers located throughout Colorado, Wyoming, and Kansas.

With 31 banking centers and counting across Colorado, Wyoming, and the Kansas City area, ANB Bank continues to flourish with a corporate culture that embraces quality service, rigorous local decision-making, and community accountability.

ANBs continued investment in its communities is apparent in its commitment to helping each customer succeed financially, and in the truthfulness it shows through every step of the way. ANB Bank is a bank unlike any other, armed with the power, talent, commitment, and safety to meet their customers business and personal financial needs. ANB is distinguished by its personal services, offering bank products with advanced technology that makes your life easier, offering flexible solutions that meet your financial needs, and offering credit limits that are big enough to sustain the growth of its customers.

Throughout the ANB footprint, the bank has more than 30 banking centers serving customers throughout Colorado, Wyoming, and the Kansas City metropolitan area. ANB Bank offers a comprehensive lineup of product offerings, including savings accounts, checking accounts, CDs, IRAs, brokerage accounts, and mortgage products. UMB offers commercial banking, which includes comprehensive deposit, lending and investment services, personal banking, which includes wealth management and financial planning services, and institutional banking, which includes asset services, business trust solutions, investment banking, and health services.

You can manage your finances using ANB’S mobile app, reviewing monthly statements, sending and receiving money, and contacting customer support representatives. Using one bank for both checking and savings can be ideal when you are looking to earn the highest returns on your earnings while maintaining convenient control of your money.

ANB’S clients primarily use American National Bank for their savings accounts, with some CDs to hold funds that they want easy access, and they use it all the time for tracking their accounts. ANB’s standard checking account has no monthly fees, rated great for those looking for an easy-to-use account.

Its largest shareholder (40%), is Arab Bank, headquartered in Amman, Jordan. Arab National Bank (ANB) is the main bank, located in Riyadh, Saudi Arabia, listed in Saudi stock exchange. Riyadh-based Arab National Bank (ANB) reported net income of 1.35 billion sars for the first half (H1) of 2022, a 24.76% increase year-on-year compared to the annualized earnings of 1.05 billion sars.

ANB is setting new standards, providing a surprising and contagious level of personal service. ANB Bank has achieved outstanding customer satisfaction ratings, based on comparatively fewer complaints reported to the Consumer Financial Protection Bureau (CFPB), a government-sponsored agency that protects consumers. ANB Bank is a fully-serviced community bank offering comprehensive consumer loan and account packages, in addition to commercial banking services.

In May 2019, ANB Bank purchased property at 910 and 918 Grand Ave., intending to tear down the two buildings, which date back to the 1915s, and construct a 9,706-square-foot, two-story bank and office space. The sales proceeds of the east Denver assets were agreed upon at $376,000, though Eon had a $276,574 secured loan against the assets by ANB Bank.

In December 2020, Incremental Oil and Gas USA Holdings Inc., an affiliate of the EON NRG Group, entered into the workout agreement. As a result of significant disruption in cash flows caused by the collapse of oil and gas prices during Q1-2020, Eon was unable to satisfy its credit facility obligations with ANB Bank. In May 2020, Eon received notice of non-payment from ANB Bank, and on 19 May 2020, the Company requested that it suspend the voluntary trading of its securities on the ASX platform. The Company continues to operate its oil and gas fields pursuant to an informal operating agreement with ANB Bank that controls payment of funds.

This bank had such an amazing opportunity to prosper, if it was able to keep the staff. UMB Banks average annual compensation is $63,921, while Reliance Banks is $61,574. Employees at Citizens Bank of Las Cruces make more than most competitors, averaging $ 64,999 a year. International financial institutions means any bank within the Top 1000 (along with its affiliated companies) measured in terms of capital in tier one, or any broker/dealer within the Top 100 measured in terms of capital.

Last Updated on August 4, 2022

URL: https://log-in.me/anbcorporation-terrell-unitedstates/