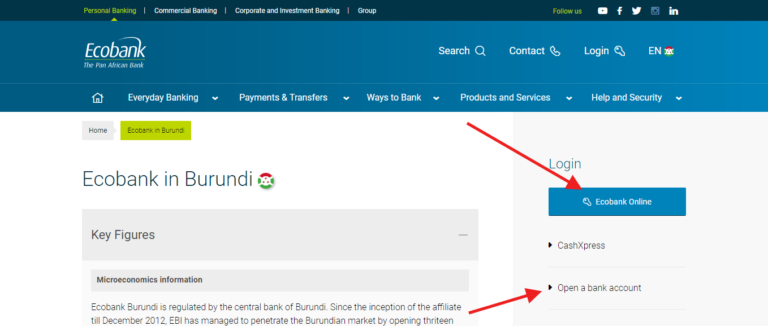

You will find the log in to the Internet bank of Ecobank Burundi, by log on to their website. The login box is in the upper right corner of the page.

Simply click on ECOBANK ONLINE. Then enter your USER ID, password and login to your account. You do not need further support for using the log in of Internet bank of Ecobank. Just make sure that you enter your user ID and password correctly, because after three wrong attempts to login, you will be blocked from logging in to your account, till you contact the customer services.

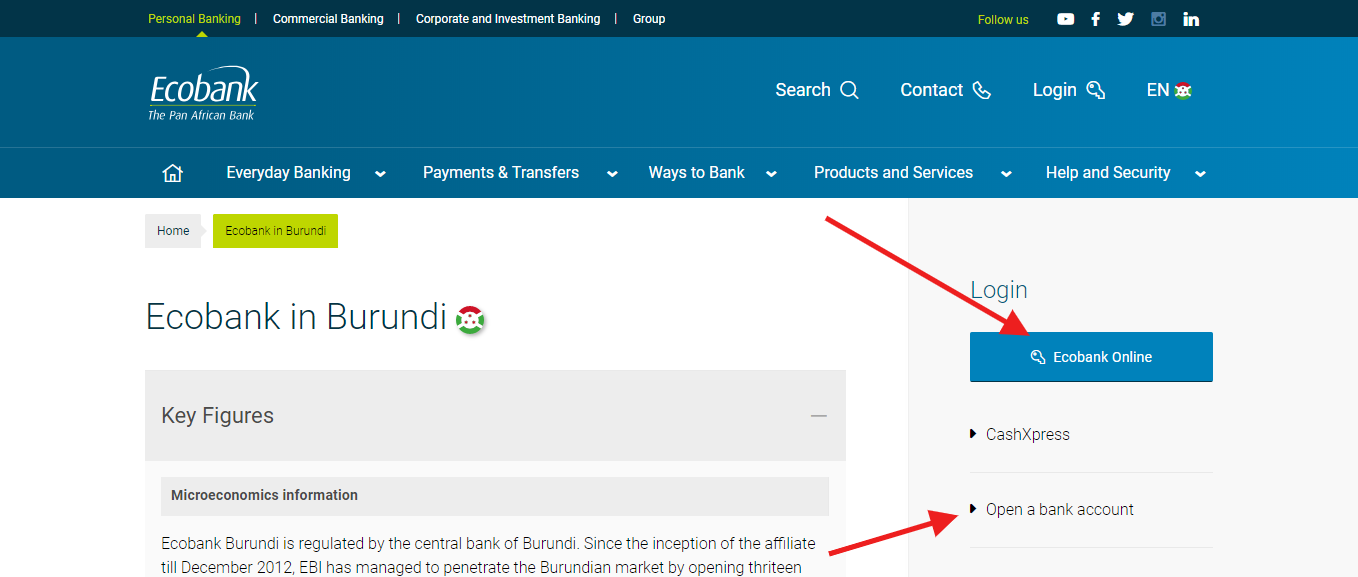

You can OPEN A BANK ACCOUNT by using the same page link provided above, just click on open a bank account as it shown in the following screenshot, and follow the process online with Ecobank.

How do you activate your Ecobank Internet Banking?

Click “Log-in to Internet Banking”

Select your country and click “Log-in to your account”

Enter your unique User ID.

Enter your unique password and confirm your Secure Image and Message.

How can you get your Ecobank account number?

On the Ecobank Mobile App your new account number will be shown on your account profile page; or. If you do not currently use internet banking or Mobile Banking, you can find your new account number on your e-statement or by contacting the Call Center.

More about Ecobank Burundi

Ecobank Transnational Incorporated is the parent company of Africas leading independent pan-African banking group. Ecobank, officially known as Ecobank Transnational Incorporated (ETI), is a pan-African banking conglomerate that operates banks in 36 African countries.

Ecobank Today

Ecobank is todays leading pan-African bank, with operations in 36 countries throughout West Africa. It would have been difficult in its infancy to have predicted that within 22 years, Ecobank would have more than 1,150 branches, and would have been hailed widely as a leading pan-African bank.

While Ecobanks headcount of 20,331 makes the organization the largest employer of labor in West Africas finance industry, the banks function is one, sharing branding, standards, policies, and processes. With over 1500 branches across 35 countries, the Ecobank-Nedbank Alliance is the largest bank network in Africa. Ecobank has become a part of mainstream banking culture across 32 Sub-Saharan African countries, with many believing that the Ecobank brand has become the dominant representation of banking to millions. With Ecobanks Mobile App, Ecobank customers can now make and receive instant payments in 33 countries, via mobile devices.

Ecobank mobile app

The Ecobank Mobile App uniquely harnesses the power of digital technology to bring customers true convenience. The new app allows customers to open a new digital account in just a few taps, without the need for a paper trail. You can open an account at the bank using the same page link provided above, simply click “Open Bank Account” as shown in the following screenshot, and then go through the online process with Ecobank. Under the license agreement, Ecobank will also distribute MasterCard products across its almost 1,300 branches, giving Ecobanks customers access to millions of MasterCard acceptance points across more than 210 countries around the world.

MasterCard and Ecobank are also exploring opportunities for joint business development in West, Central, East, and Southern Africa, and soon they will add a further four African markets to the ones that already accept MasterCard-branded cards, namely Equatorial Guinea, Mozambique, Sao Tome and Principe, and South Sudan. The culmination of the Multi-Country Licensing Agreement signed between MasterCard and Ecobank in January 2014, the MasterCard-Ecobank Initiative gives MasterCard cardholders access to over 2,500 ATMs and allows them to pay for goods and services in more than 20,000 stores, hotels, restaurants, and other retail outlets throughout Africa. ETI will leverage this capability to finance a range of subsidiaries in 36 African countries. In accordance with Ecobank Groups strategic development objectives, at least 75% of the facility will be channelled to small and medium-sized enterprises in a variety of economic sectors.

It is also aligned with Ecobanks international Financial Sector Development strategy operational priorities, promoting greater access to financing for SMEs, as well as broader and deeper African financial markets. IFC, a member of the World Bank Group, European Investment Bank (EIB) and Ecobank Transnational Incorporated (ETI), the parent company of the Ecobank Group and the leading full-service banking group in Pan-Africa, signed today a landmark risk-sharing agreement which will help close the financing gap for small-to-medium-sized businesses in some of Sub-Saharan Africas poorest and most vulnerable countries. The Ecobank-Nedbank alliance was formed in 2008 between the Groups companies and the Nedbank Group, one of the top four financial services providers in South Africa, with an expanding footprint across the Southern African Development Community. In February 2008, Ecobank Group acquired 73% of the stock capital in Loita Bank of Malawi, with the bank being renamed EcoBank Malawi.

Ecobank, was established in 1985 as a holding company in the banking industry through a private sector initiative led by the Federation of West African Chambers of Commerce and Industry, supported by the Economic Community of West African States (ECOWAS). Ecobank is a leading independent regional banking group across West and Central Africa, serving both wholesale and retail customers. Ecobank is a full-service bank providing wholesale, retail, investment, and transaction banking services and products to governments, financial institutions, multinationals, international organizations, mid-market, small-to-micro enterprises, and individuals. In addition to Togo, home of Ecobanks head office, the Pan-African banking group is present in the French-speaking West African zones of Ivory Coast, Guinea, Senegal, Burkina Faso, Benin, Mali, and Niger.

In addition, the French-speaking West African subsidiaries now represent over 40% of Ecobanks profit margin. In 2020, French-speaking West African subsidiaries represented 87% of the earnings before income taxes, reflecting a negative effect of eliminating internal group operations (-$330 million) and other subsidiaries and structured entities (including holding companies, eProcess, and Ecobank International Paris) on earnings. Ecobank also has an authorized operations in Paris, as well as representation offices in Beijing, Dubai, Johannesburg, London, and Luanda.

The Board of Directors of the African Development Bank approved an unfunded $35-million risk-sharing facility to support trade financing activities of the Africa branch of Ecobank International, EBI SA, on November 19, 2021. As per bank internal policies, the incumbent Ecobank Nigeria Limited managing director, Jibril Aku, has completed five years as managing director, and he will be retiring from the role he holds at the end of this year. He then joined its largest affiliate as executive director responsible for bankings Treasury and Financial Institutions Business in 2006, after which he was appointed as the managing director of Ecobank Nigeria in 2010.

His companys flagship product, the mobile application, offers banking services for a far cheaper rate than traditional banking, thereby making it far more accessible to millions of users due to rapid rise of use of mobile phones.

Last Updated on June 10, 2022

URL: https://log-in.me/ecobankburundi-bujumbura-burundi/