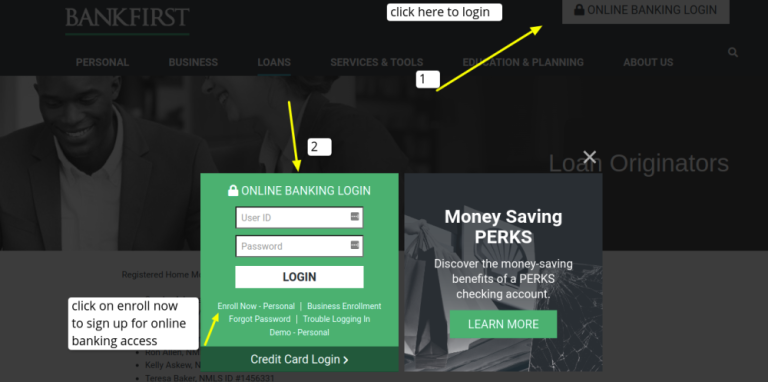

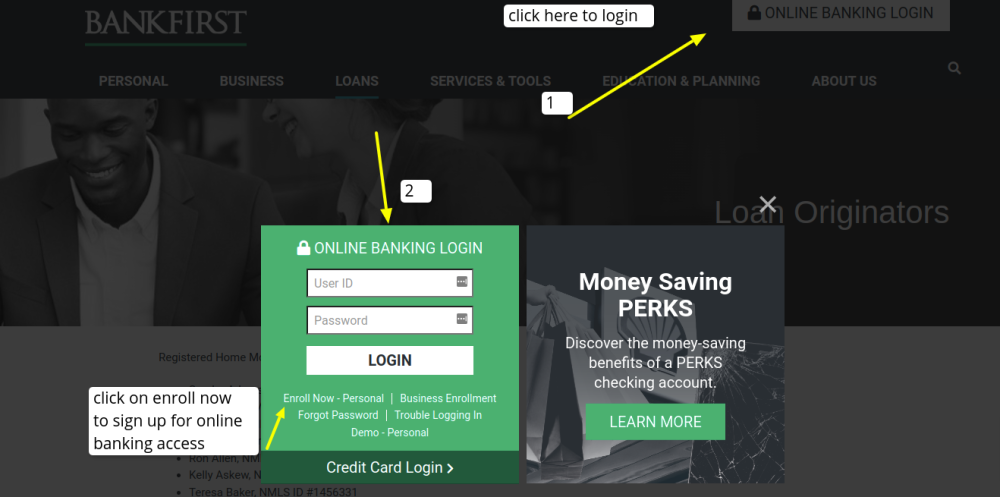

You will find the log in to Marshall Bankfirst Corporation, by visiting their website’s home page https://www.bankfirstfs.com/ the login box is located in the upper right corner of the home page, per the following screenshot. Click on online banking login, enter your user id, password and login to your account with Bank First.

If you are already a client with Bank First, and you would like to have access to their online banking services, all you need to do is to click on online banking login and then click on Enroll now, enter the required data, fill a shirt form, and submit it online for approval. Please check the following screenshot for your guidance.

About Marshall Bankfirst Corporation

John Marshall Bancorp, Inc. is a holding company of the Bank of John Marshall. Founded in 1943, Marshall Bank of Hallock was a branch of Marshall BankFirst Corp., a holding company with two banks, which ran into problems after one of its subsidiaries, BankFirst of Sioux Falls, South Dakota, made hundreds of millions of dollars of syndicated loans on commercial real estate. Marshall BankFirst Corp. made hundreds of millions of dollars of syndicated loans on commercial real estate. The remainder was sold to First Dakota National Bank, in Yankton, S.D., which would run the BankFirst location in Sioux Falls.

Alerus Financial, a bank based in Grand Forks, N.D., that had $800 million in assets on March 31, assumed the deposits from BankFirst. In addition to taking over all the failed banks deposits, Alerus Financial would receive $72 million in assets, according to the FDICs press release. The FDIC said it has entered into a separate deal with Beal Bank Nevada, based in Las Vegas, to buy $177 million of loans from the failed bank.

The new firm bought out its two competitors, Northern Bank and Bank of Commerce. Bank Stock changed its name accordingly in 1971 to Marshall & Ilsley Corporation. In 1986, Marshall & Ilsley expanded beyond Wisconsin, purchasing Thunderbird Bank, which was based in Arizona. In 1987, Marshall & Ilsley attempted to purchase the Milwaukee Marine Corporation, parent company of Marine Bank, by a hostile takeover.

Marshall & Ilsley was merged into a BMO subsidiary, Harris Bank, located in Chicago, Illinois, on October 9, 2012, forming BMO Harris Bank. Marshall & Ilsley Corporation (also known as M&I Bank) is an American banking and financial services company diversified with headquarters in Milwaukee, Wisconsin, purchased from Bank of Montreal in 2010. John Marshall Bank (JMB or theBank) was a $2.1 billion bank headquartered in Reston, Virginia, with eight full-service branches located in Alexandria, Arlington, Loudoun, Prince William, Reston, and Tysons, Virginia, and in Rockville, Maryland, and Washington, D.C., with one loan origination office in Arlington, Virginia.

John Marshall Bank offers personal and commercial banking services including checking and deposit services, lending solutions, cash management, personal loans, and other financial services. Denmark State Bank offers a wide range of financial products and services including loans, deposits, mortgage banking, and investment services. Texas National Bank offers a wide range of financing including commercial loans, personal loans, and real estate loans.

Bank First Corporation offers lending, deposits, and Treasury Management products in each of its 21 banking locations throughout Wisconsin. Bank Firsts is a Manitowoc, Wisconsin-based, publicly traded company that has total assets of approximately $2.9 billion. Hometown Bancorp, Ltd is a bank holding company headquartered in Fond du Lac, Wisconsin with total assets of approximately $627.6 million.

Bank First Corporation employs approximately 279 full-time and full-time equivalent employees and has assets of approximately $2.9 billion. First Business Financial Services, Inc., the parent of First Business Bank, is a bank holding company that is publicly traded, focused on the unique needs of businesses, corporate executives, and high-net-worth individuals. Bank First Corporation provides financial services through Bank First Corporation.

Trust, investment advisory, and other financial services are offered through the banks partnership with Legacy Private Trust, as well as through its affiliation with Morgan Stanley. Bank Firsts primary business is ownership and operations of Bank First, a nationally chartered community bank operating 21 banking centers serving Wisconsin. Hometowns primary activity is ownership and operation of its wholly owned subsidiary, Hometown Bank. Until it was acquired, BankFirst was a subsidiary of Marshall-based BankFirst, owned by Denny Mathisen.

The Federal Deposit Insurance Corporation, acting as receiver of Marshall Bank, National Association, Hallock, Minnesota, has taken all actions necessary to dissolve the receivership. Your transferred deposits are insured separately from any accounts you may already have with United Valley Bank for a minimum of six months following closing.

Although the state of Wisconsin did not permit publicly chartered banks at that time, an exchange brokerage provided many of the traditional banking services, like deposits and loans. The bank went from having about $200 million in assets to more than $1 billion under the leadership of Tim Marshall.

In his role as chairman, Tim meets twice per year in Washington, DC, with the Board of Governors of the Federal Reserve System, addressing the economy and trends in the banking industry. In 1994, Tim Marshall moved to Indianapolis-based Salin Bank & Trust Co., where his managerial duties have varied from serving as chief credit officer, to managing all functional lines of business, to serving as president, chief operating officer, and board director at Salin. Prior to joining Bremer Financial Corporation in 2001, Mr. Clifford served as the President and Chairman of Firstar Bank of Minnesota.

Mr. Clifford recently served as Senior Vice President and Chief Commercial Banking Officer of Bremer Financial Corporation, a $5.7 billion financial services firm headquartered in St. Paul, Minn.

Jules Blaise Tamo is a long-time Arlington business banker who joined John Marshall Bank after serving as a branch manager and business specialist for United Bank, and branch operations manager and branch manager at Virginia Commerce Bank. Tim Marshall is the president and chief executive officer of Arbor Bancorp, Inc. and the Bank of Ann Arbor, a full-service, locally owned and operated community bank with eight locations serving the people of Michigan across Southeast Michigan. Prior to joining Powell Valley National Bank, Leton Harding served as Executive Vice President at First Bank & Trust Company from 1993-2012, where he oversaw day-to-day operations and investment services. Mr. Mathisen is also a principal owner of The Marshall Group, Inc., a national investment bank that syndicates commercial and industrial loans.

Last Updated on July 27, 2022

URL: https://log-in.me/marshallbankfirstcorporation-minneapolis-unitedstates/