How to login to my account with Raymond James bank?

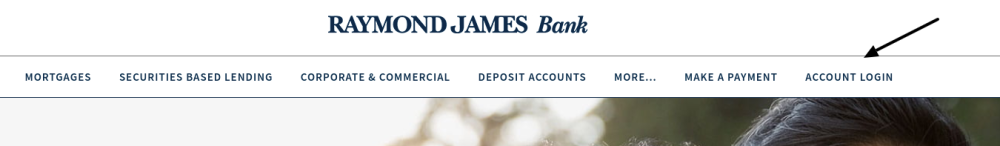

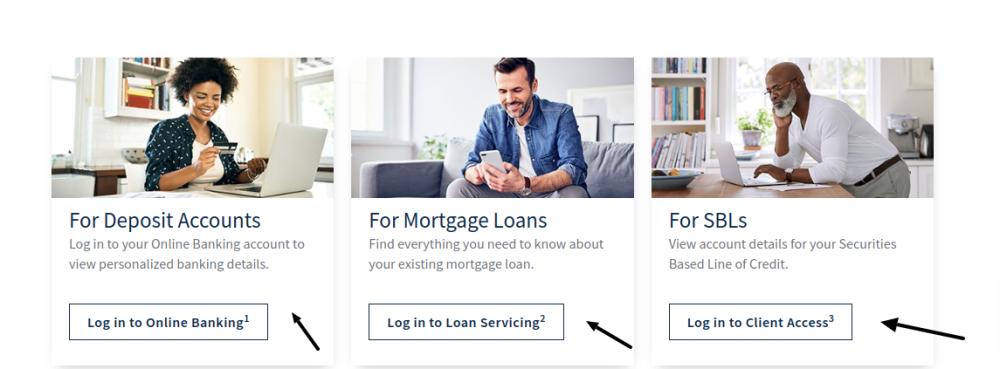

In order to login to your account with Raymond James bank, go to their website in the home page click on account login , which is located in the upper right corner of the home page. You will get another page giving you the choice to login to the account type you have with Raymond James bank. Whether it is Deposit account login, mortgage loans login and SBLs account login. Just select your account and click on log in as the following screenshots shows.

If you are already a client and you haven’t registered to Raymond James bank’s online banking services, you can simply do the same steps for login. Click on account login, then select the type of your account, then click on register online or enroll now. Go with the process online by filling a short form then submit it online.

Raymond James Financial, Inc. is an American multinational investment bank and financial services firm headquartered in St. Petersburg, Florida, U.S. Raymond James is a leading diverse financial services firm providing personal client groups, capital markets, asset management, banking, and other services to individuals, corporations, and municipalities.

Raymond James Financial is an American multinational, independent investment bank and financial services company providing financial services to individuals, corporations and municipalities through its wholly owned subsidiaries, which focus primarily on investing and financial planning, as well as investment banking and asset management. Raymond James & Associates, a sub-division, provides securities brokerage, investment banking, and financial advisory services.

In 2000, Raymond James Financial joined Killik & Co. in launching a new brokerage in the UK–Raymond James Killik Limited (later Raymond James Investment Services Limited)–to provide financial planning and investing services via Independent Contractor Financial Advisors. During the late 1960s, Robert A. James Investments expanded its services, beginning to engage in investment banking and general insurance agency activities. During 1964, the firm expanded to the Bradenton-Sarasota area with a merger with Raymond and Associates, another firm of the family’s name.

Raymond James Financial has acquired a number of smaller organizations over the last year, including Financo, a boutique investment bank, the investment advisor Cebile Capital, and the British asset management firm Charles Stanley. In September 2016, the firm announced it had acquired the U.S. private client services division of Deutsche Bank Wealth Management, Alex Brown & Sons. The bank and asset manager will remain an independent brand serving other firms, whereas Raymond James will continue to offer SBL services to its own financial advisers, said Reilly. Raymond James plans to invest in TriStates technologies and services, Reilly added, stressing the excess capital that the Reilly firms had available for deployment and the space for TriState to grow.

As another reason for inking the acquisition, Raymond James points to the banks strengths in commercial loans in the mid-market, where the bank has grown by 18 percent annually since 2017, reaching $3.7 billion at Sept. 30, according to the firm. TriState Capitals banking franchise includes private bank and commercial loans focused on the middle market, with about $10 billion of loans. Through its bank-free, no-branch model, which has more than $12 billion in assets, TriState Capital is a leading national originator of securities-based loans to clients from independent investment advisory firms, trust companies, broker-dealers, regional securities firms, family offices, insurance companies, and other financial intermediaries who do not offer banking services on their own. The bank and asset manager provides loan services to high-net-worth individuals working with RIRAs, trust companies, broker-dealers, family offices and other financial firms, according to the company.

Aurigin allows accounting firms to connect their clients to qualified investment opportunities, as well as funding providers, worldwide. Aurigin is a global transaction origination platform connecting qualified investment opportunities with institutional capital providers. Brokerage and asset management firms are increasingly offering clients bank and credit services on top of their traditional investment advisory, an effort intended to meet a greater client need and increase the firms portfolio share. They can connect you with a banking advisor to start on the right track to applying for credit or setting up a new account.

Chase has many different credit cards to choose from, as well as checking and savings accounts, and other banking products. Ally Bank is an online-only bank offering excellent rates on savings accounts and CDs, along with a wide variety of lending and investing services. Regardless of whether the bank charges fees for maintaining accounts, most do charge fees for other activities and services.

By keeping checking and savings accounts together with investments, you get one integrated account statement, which provides a more comprehensive financial picture. Editors favorite bank Raymond James The key selling point is Raymond James Bank allows you to have all your financial assets under one roof, including checking accounts, savings accounts, CDs, loans, and investments. Whether you are a single person investing for the first time, a retiree thinking about how to pass assets down to your heirs, or a business owner looking for direction, Aaron and James Laqua have your whole financial picture in mind to help you reach your goals.

Raymond James Associates, Inc., Raymond James Financial Services, Inc., and your Raymond James Bank Financial Advisors do not solicit or offer residential mortgage products, nor are they in a position to accept any residential mortgage application, nor offer or negotiate terms for any such loan. The proceeds from a securities-based credit facility or a structured line of credit may not be used for the purchase or holding of securities; deposited in Raymond James Investments or Trust Accounts; used for the purchase of any products issued by Raymond James affiliates or underwritten, including insurance; or otherwise used to benefit, or transfer to, Raymond James affiliates.

The proceeds from a Securities Based Line of Credit or a structured line of credit can not be used to purchase or carry securities ; deposited into a Raymond James investment or trust account ; used to purchase any product issued or brokered through an affiliate of Raymond James, including insurance ; or otherwise used for the benefit of, or transferred to, an affiliate of Raymond James. Raymond James can then invest the banks relatively low-cost deposits in higher-yielding loans, boosting its own growth in a period in which interest rates have remained stubbornly low and loan margins are tight. The transaction is really about tomorrow and taking this business much higher velocity and taking advantage of Raymond Jamessvery strong balance sheet, said James Getz, TriStates Chairman, President and Chief Executive Officer. TriState Capital will continue to operate as an independent branded firm, as well as a standalone unit, and independently chartered banking affiliate, of Raymond James, with Jim Getz remaining as Chairman, Bryan Fetterolf remaining as CEO of TriState Capital Bank, and Tim Riddle remaining as Chief Executive Officer of Chartwell.

Last Updated on June 19, 2022

URL: https://log-in.me/raymondjamesfinancial-stpetersburg-florida-unitedstates/