How to login to my account with Axis bank?

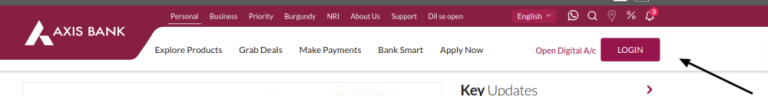

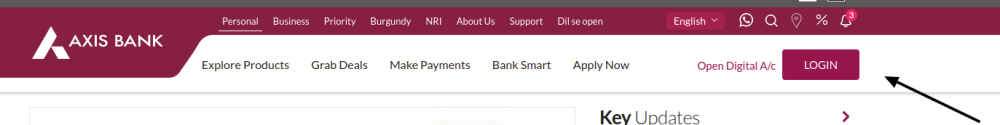

To login to your Axis Bank account, go to their website https://www.axisbank.com/ The log in box is in the upper right corner of the homepage, click on LOGIN, enter your username, password and login to your account with Axis Bank.

How to open a digital account with Axis bank?

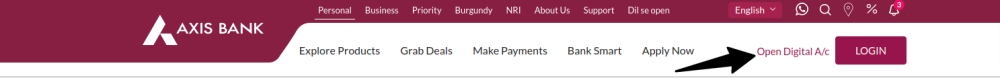

To open a digital account with axis bank, go to their home page https://www.axisbank.com/ click on open Digital A/c, which is located in the upper right side corner of the home page. You will get mane options of opening bank accounts and other different services, click on the one that suits your need. Go with the steps online, fill the form and submit for approval.

Axis Bank Limited has nine international offices, with branches in Singapore, Hong Kong, Dubai (at Dubai International Finance Centre), Shanghai, Colombo, and representative offices in Dhaka, Dubai, Sharjah, and Abu Dhabi, focused on business credit, commercial financing, syndicated finance, investment banking, and liabilities.

Axis Bank Limited offers credit services to individuals and small businesses, as well as liability products, card services, Internet banking, automatic teller machine (ATM) services, depository services, financial advisory services, and services for Non-Resident Indians (NRIs). The bank offers business banking, trade financing, treasury, and risk management via branches in Singapore, Hong Kong, DIFC, Shanghai, and Colombo, as well as retail liabilities products through the Singapore subsidiary. Axis Private Equity Ltd. was incorporated in India as a fully owned subsidiary of Axis Bank Limited on 3 October 2006, and received its Certificate of Establishment of Axis Private Equity Ltd. on 4 December 2006.

Axis Capital Limited provides investment banking services related to Equity capital markets, Institutional share brokerage, in addition to advisory on mergers & acquisitions. Axis Bank offers a full range of financial services for client segments, covering big & medium enterprises, small & medium enterprises, retail businesses. Axis Bank is the leading private sector bank in India with over 20 million customers and more than 4000 branches spread across the country.

Major players operating in the retail banking industry include Yes Bank Limited, Axis Bank Limited, Bandhan Bank Limited, State Bank of India Limited, and HDFC Bank Limited. The retail banking sector, which is now comprising the network of 96,068 branches, comprises of Public Sector, Private Sector, Foreign, Regional, Rural, Cooperative banks (urban and rural). Public sector banks had about 82,730 ATMs at locations across India and around 63,234 ATMs at non-locations over the same period.

The adoption of Internet-based banking facilities has made transactions easier, thus increasing account-to-account transactions volume in India. Various public initiatives such as increasing bank community service units in rural areas, the Pradhan Mantri Jan Dhan Yojana scheme, the availability of zero-transaction limits credit cards and debit cards, and promotion of technology-based banking systems are driving growth of Indias retail banking sector. State Bank of India (SBI) has recently launched the WhatsApp Banking Service to its customers. Axis Bank offers fixed deposit services via WhatsApp Banking, as well as account-related services including account balance, mini statements, order chequebooks, instant KYC opened accounts, and blocking debit cards.

Personal banking includes accounts, deposits, cards, loans, investment solutions, NRI services, and farm & rural banking. Customers, who previously had to visit a bank branch for various services, can carry out these tasks from their homes or offices via banks Net Banking and Mobile Banking platforms. Users can invest via SIP or Lumpsum using Netbanking across all supported banks.

Citibank customers, which become a part of Axis Banks, have access to a far wider network of branches nationwide, hence better services, whereas Axis customers get high-quality personal banking and asset management services, thanks to Citibanks talented pool.

With access to a highly valuable clientele, a wealth management operation, and a large high-quality portfolio of credit cards, Axis Bank could see growth in more than just the Axis Banks retail operations, but a growth in the revenues it is able to deliver per customer, owing to the improved services it is able to deliver. While Axis is currently offering certain insurance products through a partnership with Max Financial, a Go Digit Life insurance agreement could give Axis better visibility into the online insurance sector and enable it to enhance outreach to insurance customers through its banking offerings, a source said.

The plans highlight growing interest in Indias lucrative insurance business among private lenders, said one source, adding that partnering with Go Digit Life Insurance may help Axis Banks fulfil its insurance ambitions. Axis Bank is using Cloudera to better analyse operations and forecast customer behaviour in the Axis Banks retail and commercial business units, including savings, credit, investments, and exchanging services.

Axis Bank, one of the largest private sector lenders in the country, reported an increase in stand-alone profits of 91% YoY of Rs4,125 crore as against Rs2,160 crore for yr-ago period, the bank said in its regulatory filing. Axis Bank Ltd. posted more than a tripling of net profit in Q3 to Rs3,614 crore, driven by an increase in net interest revenue and improved asset quality. On a quarter-on-quarter average balance basis, deposits at Axis Bank increased by 22% YoY and 3% QoQ in the October-December quarter, whereas deposits under Current Accounts and Savings Accounts (CASA) increased by 25% YoY and 7% QoQ. Despite being a seasonally weak period, the August payment data of Reserve Bank of India (RBI) sets new records, suggesting strong upturn in consumption.

Flipkart Axis Bank credit card benefits on popular apps The Flipkart Axis Bank credit card offers several benefits on high-rated, high-usage apps like Uber, PVR, Swiggy, Curefit, Myntra, and Tata Sky. Axis Mobile is a secure, reliable, user-friendly mobile banking app that comes with 250+ advanced features and services that cater to more than your usual banking needs. Apart from the interactive dashboard, you will also configure 6 digit MPIN while using Axis Mobile, it is cross-platform security code which helps in verifying funds transfers from savings accounts and transactions in the app, and logging into Internet Banking and authenticating debit/credit card payments.

Last Updated on February 9, 2023

URL: https://log-in.me/axisbank-mumbai-india/