The present-day Bank of Abyssinia was established on February 15, 1996.

In two decades since its establishment Bank of Abyssinia has registered a significant growth in paid up capital and total assets.

Bank of Abyssinia’s mission is to provide customer-focused financial services through competent, motivated employees and modern technology in order to maximize value to all stakeholders.

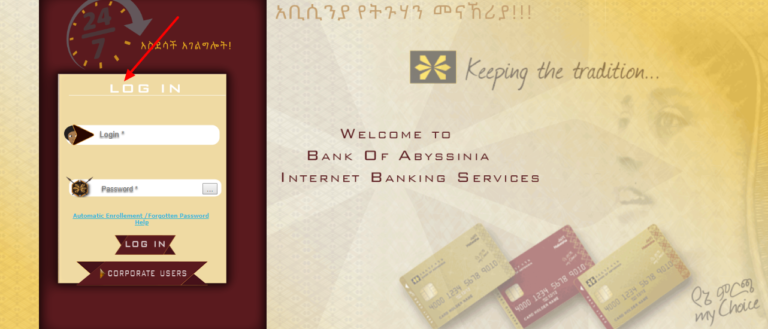

You will find the log in to the Internet bank of Bank of Abyssinia, Addis Ababa, Ethiopia when by log on to their website at https://www.bankofabyssinia.com/.

The log in box is on the left side of the site. You do not need further support for using the log in of Internet bank of Bank of Abyssinia, Ethiopia since they have modernized their internet banking. Log in to online banking from the front page of Bank of Abyssinia, Ethiopia.

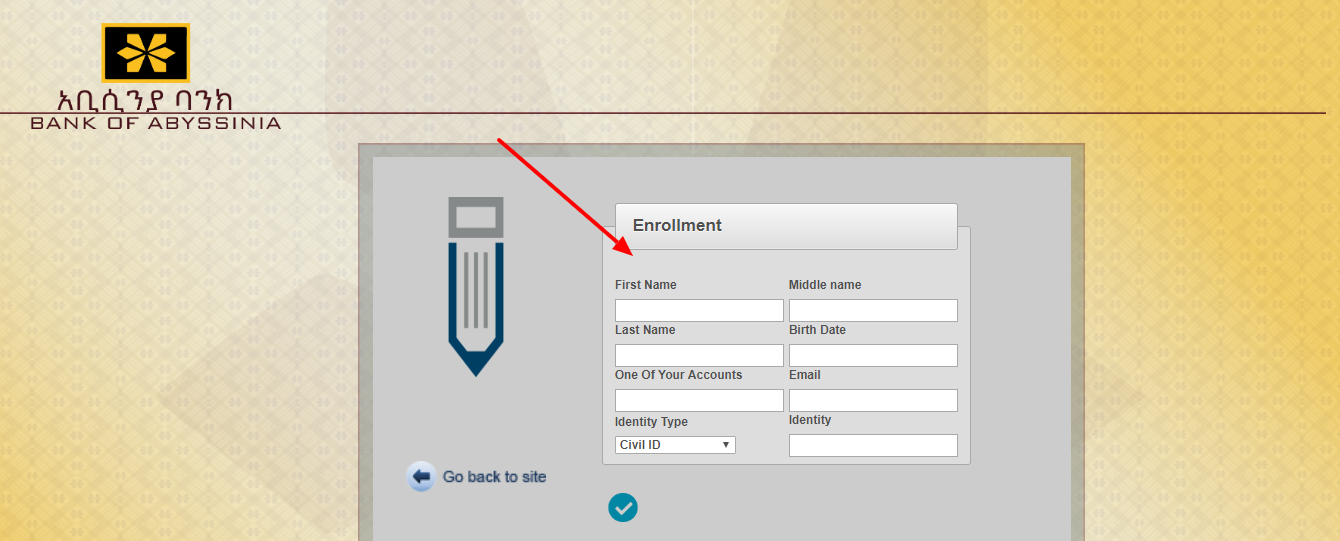

Besides logging in to Bank of Abyssinia, Addis Ababa, Ethiopia , you might also be able to register a new account with Bank of Abyssinia, Addis Ababa, Ethiopia . Many sites like Bank of Abyssinia, Addis Ababa, Ethiopia offer that you can register an account by filling the requirements in this website (https://www.bankofabyssinia.com/) to finish your enrollment in the Bank of Abyssinia, Ethiopia.

More about login to Bank of Abyssinia, Ethiopia

Bank of Abyssinia was the first bank to introduce Internet Banking in Ethiopia, making it a leading Ethiopian Bank. Speaking about the partnership, Willie Kanyeki, regional director for east and southern Africa at TerraPay said, We are excited to be working with the leading bank of Ethiopia, the Bank of Abyssinia, for transfers into bank accounts. Now, as part of this partnership, Bank of Abyssinia will be able to connect with our Ethiopian customer partners in our network of global banking accounts and mobile wallet partners.

Bank of Abyssinia is one of Ethiopias leading banks, and is excited to announce they will use Temenos Infinity as the platform for them to begin the digital transformation journey. When Bank of Abyssinia decided to choose Temenos Infinity to transform its digital banking, it needed a service partner who was seasoned, committed, and trusted, knowledgeable about the challenges in digital banking, as well as having proven Temenos Infinity deployment experience.

Bank of Abyssinia, the leading and fast-growing bank in Ethiopias regional economy, has announced a partnership with Temenos certified professional services partner in the Middle East and Africa, Xpert Digital (XD). Xpert Digital (XD), Temenos certified professional services partner in the Middle East and Africa, for Temenos implementation of Temenos Infinity. On a journey of strengthening and uniting the global payments ecosystem, offering seamless, cross-border money transfers, global payments infrastructure company TerraPay has announced a partnership with Ethiopias Bank of Abyssinia.

Paga Group, a leading mobile payments and financial services company, is pleased to announce a partnership with the Bank of Abyssinia, as well as the Paga Groups obtaining of regulatory authorization from the Ethiopian National Bank, for launching its online payments gateway in Ethiopia.

VISA Network agreement

Previously, the Abyssinia Bank signed a strategic partnership agreement with VISA, and subsequently acquired Visas CyberSource Payment Gateway, enabling businesses to accept online payments using credit cards. They are pleased to be the first bank to deploy Visa CyberSource payment gateways in Ethiopia and start the e-commerce acquisitions activities. It is also one of the leading banks that launched technology-enabled banking products into Ethiopian markets, starting as the primary acquirer of Visa members for ATMs and Point of Sale services. Currently, by employing the latest banking technologies, Bank provides superior banking services at home, internationally, and for special customers.

Public confidence in the bank

This performance indicates public confidence in the Bank, as well as confidence in, and satisfaction with, its services. The bank is also making efforts through a variety of other digital initiatives to broaden its payment menu, creating greater convenience and easiness for its customers. Bank of Abyssinia has implemented three strategies in the past year, yet it has lagged its peers competitors on deposits, market share, and general performance, although the bank started operations offering some innovative products like Gift Savings Accounts, Safe Deposit Boxes, and Savings Accounts linked with Current Accounts/SALCA/, which allow customers to move funds from one savings account to one current account for drawing checks in case there is not enough balance on the current account. To survive in the market and gain a competitive edge against other competing banks, adoption of technology-oriented products and services is an unavoidable thing, and being the last to take up the technology-oriented projects makes it necessary for bank to draw on existing experiences of banks that adopted those products early on.

Currently, the bank has 1515 shareholders and 400,000 account holders, with a total deposits of 9.4bn BR, 103 branches throughout the country, and 3,000 employees. The bank was established in 1996 with a 50-million-br authorized capital, a paid-up capital of 17.8-million br, and 131 shareholders. One of Ethiopias largest banks, the Bank of Abyssinia generated a one-billion-birr profit in its latest financial year, and so far, its shareholders have invested more than 3.1 billion BRL paid-up capital. The Ethiopian-based bank, with more than 4.6 million customers and 580+ branches and Islamic windows, is set to deploy the iMAL IslamicFinancing by Path Solutions and the iMAL Profit Calculation System (PCS) to run Sharia-compliant operations.

With the companys suite of Islamic banking products certified by the AAOIFI, BoA will be able to compete both, with Islamic banks and with traditional bank methods for disbursing interest, on rates and client satisfaction, while also shortening the time-to-market of new products and profit sharing. Temenos Infinity will provide BoA customers the opportunity for seamless, reliable, simple-to-use, secure mobile banking services. BoA said that a digital banking platform will enable them to provide robust, easy-to-use mobile banking services, as well as reducing time-to-reach customers, as well as increasing digital revenues through data analytics. I believe it will allow emerging eCommerce businesses to scale up and scale out even more, said BoAs chief digital banking officer, Sosina Mengesha.

Abdulkadir Redwan, Director of Interest-Free Banking at BoA, said, “Islamic banks have grown quickly in Ethiopia over the past few years. Bank of Abyssinia (BOA) has launched five Virtual Machines, which allow customers to open accounts, deposit and withdraw money, and make local transfers. BOA has a mobile app called BOA 2FA Two-factor authentication is used for authentication, transaction authorization, and a digital signature, which allows customers to securely access their accounts and conduct safe online banking transactions. You do not need any additional support for using Internet Banking Login for Bank of Abyssinia today as they modernized their Internet Banking.

CashGo is the Digital Remittance Service Platform that Sol-Get Travel provided for Abyssinia Bank one year ago. Using the application, customers at Abyssinia Bank can send one dollar up to $15,000, while recipients can get money in their accounts immediately, explained Tedros Shiferaw. Mulugeta Asmare has worked in banking for 22 years, 18 of which were with Commercial Bank of Ethiopia (CBE).

Last Updated on June 18, 2022

URL: https://log-in.me/bankofabyssinia-addisababa-ethiopia/