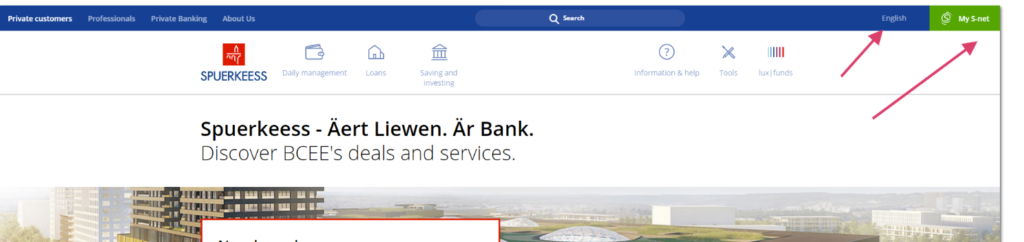

To login to your account: Visit the e website/home page https://www.bcee.lu/en – The website is offered in French, English and Deutsche languages, so you can switch between these three languages. The languages box is located in the home page, upper right corner. Click on the language box and select the language t hat suits you better. To login to your account with Banque et Caisse d’Epargne de l’Etat, Luxembourg, the log in box is in the upper right corner of the home page, under My S-net. Click on My S-net, then select your device. meaning select the device/method you would like to login with. Token, or smart card, or signing stick , identity card or Lux Trust Mobile. Whatever the device or method you are going to choose, you will be asked to enter your use id and password or similar, depend on the device you are going to use to login to your account with Banque et Caisse d’Epargne de l’Etat, Luxembourg.

To become a client of Banque et Caisse d’Epargne de l’Etat, Luxembourg, You visit/go to the same above provided home page link. Go a little bit further down in the page, then click on I become a customer. Fill the application form and then move to step 2, till you finish filling the form online and submit it for approval to the Banque et Caisse d’Epargne de l’Etat, Luxembourg. Whether you need to login, or to become a client, check the following screenshot for your guidance.

Since 1856. Bank of the State, Luxembourg is the largest network of agencies and self-banking spaces in Luxembourg. 1,800 employees to meet your needs and support you in your projects. Standard & Poor’s and Moody’s international rating agencies have awarded BCEE some of the best ratings in the world. Bank of the State, Luxembourgour advisors provide you with their know-how and experience in international financial markets.

Banque et Caisse d’Epargne de l’Etat, Luxembourg provides financial and banking products and services for private customers, small and medium enterprises, self-employed professionals, and institutional customers in Luxembourg. It operates through Retail, Professional, Corporate, and Public Sector Banking; Financial Markets and Investment Funds; and Other segments. The company offers savings and investments products, including deposits, savings accounts, digital and personalized investment plans, various funds, equities and bonds, and precious metals, as well as S-pension, S-invest, and S-invest gold products; and portfolio, fund, and risk management services. It also provides housing, personal, student, investment, and mortgage loans; personal reserve and overdraft facilities; bank guarantees and state support facilities; and customized financing solutions.

In addition, the company offers leasing services, insurances, and credit cards; and wealth management solutions, such as short and medium-term investments comprising notice savings accounts, investment funds, structured products, institutional management, etc., as well as personal wealth services. Further, it provides trading room services, including access to international markets and various financial instruments; custody services; fund administration and cash management services; precious metal deposit services; payment and employee benefit services; and listing services, as well as private banking services. Additionally, the company offers treasury, trading, asset and liability management, and mutual fund administration and management services.

Last Updated on June 7, 2022

URL: https://log-in.me/banqueetcaissedepargnedeletat-luxembourg-luxembourg-luxembourg/