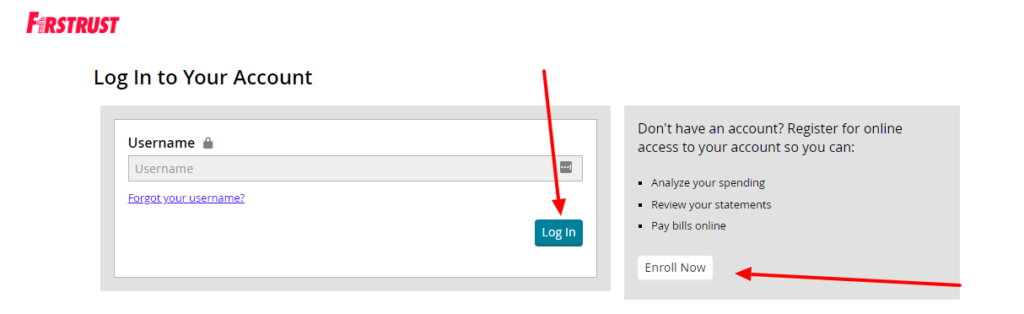

First trust bank’s website made it really very easy for their clients to navigate and search for different kinds of services, without feeling bored or lost. If you are a client and would like to login to your account with with Firstrust Platinum Visa® Card, simply go to the home page or their website: https://www.firstrust.com/ – The log in box is in the upper right corner of the page under login. Click on login, then click on credit cards. Then enter your username and click login.

What if you don’t have an online account with First trust bank?

If you Don’t have an account, you can Register for online access services, by repeating same steps above for login, then click on Enroll now. Check the screenshots for your guidance.

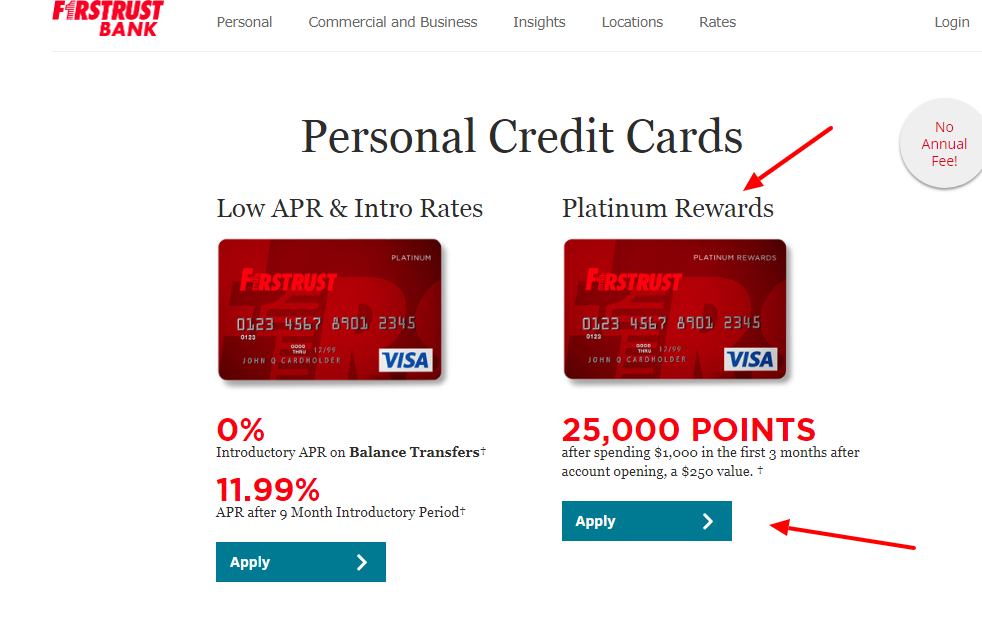

Another way to apply for Firstrust Platinum Visa® Card

- Use this link to Firstrust Bank’s personal credit card page: https://www.firstrust.com/personal/personal-credit-cards/

- You can choose from the two personal credit card options they offer; Platinum or Platinum Rewards. Click on the Apply button below the image of the card, as shown in the screenshot below.

- They ask that you provide some very basic personal information in these next steps. Start by entering the following information:

Name

Social security number

Date of birth

Email address

Physical address

Phone number

How many months at his address

-

- Go with the process online till you submit your application form for approval.

How First Trust Bank Will Calculate Your Balance?

- They use a method called “average daily balance (including new transactions)”. See your Card Agreement for further

information regarding how they calculate your balance. - Billing Rights: Information on your rights to dispute transactions and how to exercise those rights is provided in your Card Agreement.

- Loss of Introductory APR: They may end your introductory APR and apply the post-introductory APR if you become more than 30 days late in paying your bill.

- Rates, Fees and Terms May Change: They have the right to change the account terms (including APRs) in accordance with the terms of your Card Agreement.

- To receive a Firstrust Credit Card, you must meet their applicable criteria bearing on creditworthiness. Your credit limit will be determined by the income you provided and a review of your debt listed on your credit report. You will be informed of the amount of your credit limit when you receive your card. Some credit limits may be as low as $250. Please note that cash advances may be limited to a portion of your credit limit.

- BALANCE TRANSFERS: You authorize them to make one or more of the balance transfers that you have requested. All balance transfer requests are subject to their approval; They reserve the right to make balance transfers in the order they select and to limit the

amount of the balance transfer that they make (this amount may be less than your total credit limit). If you request an amount that they do not approve, they may process a partial transfer for less than you requested or they may decline the entire request. - The amount of available credit on your new account will be reduced by the amount transferred and the related balance transfer fees. In addition, transfer requests that are incomplete, illegible or requested to cash, to yourself or to another account with them or one of their affiliates need not be processed. To protect your billing rights, do not request a balance transfer of an amount you might dispute with another creditor.

- Allow 4 weeks from account opening for each balance transfer. Continue paying your other creditors the amounts owed for each balance transfer you request, until you receive a billing statement from those creditors showing the requested balance transfer has been processed.

- IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT: To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person (including business entities) who

opens an account.

What this means for you: When you open an account, they will ask for your name, physical address, date of birth, and other information that will allow them to identify you. They may ask for other identifying documents. They will let you know if additional information is required.

Last Updated on June 7, 2022

URL: https://log-in.me/credit-card/firstrustplatinumvisacard/