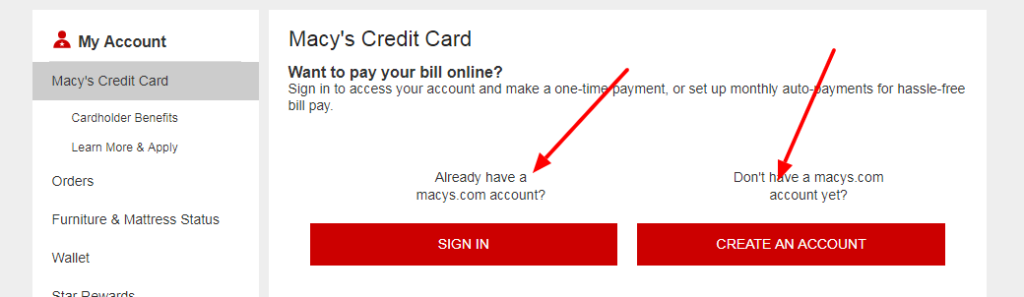

You will find the login to your account with Macy’s American Express Card by logging in to their website:

- https://www.macys.com/my-credit/gateway/guest

- The log in box is in the upper right corner of the page under sign in. Click on sign in and enter your user name and password and login to your account.

- You can register a new account with Macy’s American Express® Card, by using the same link provided above. On the left corner click on create an account to register your account with Macy’s American Express® Card.

The Amex version of the Macy’s credit card can be used anywhere American Express is accepted, and the store card can be used at Macy’s only (in-store and online). No annual fee, but there is a hefty APR of 27.49% for purchases, as well as cash advances. The late fee and returned payment fee are both up to $39. This is the same deal as is offered with the standard Macy’s card. Clearly, it’s wise to pay your balance in full every month. The Macy’s Credit Card is a store credit card that can only be used at Macy’s. It offers discounts and offers for cardholders, and provides more benefits the more you spend.

How long does it take to get approved for a Macy’s credit card?

7 to 10 days

On average, it takes 7 to 10 days for an application to be processed. You will usually get a letter or e-mail letting you know that your application was accepted. Your card should arrive shortly thereafter. Macy’s store cards are somewhat harder to obtain that most store credit cards. The minimum interest charge for both of the Macy’s cards is $2. When you carry a balance from one month to the next on your card you’ll be charged interest at a very high rate of 27.49% Variable; if your interest charge would be less than $2, it’s automatically increased to $2. You can cancel your Macy’s Credit Card by calling the phone number on the back of the card. Just state your request and provide the information necessary to confirm your identity.

About Macy’s American Express® Card

In this article, we’ll cover Macys Basic Credit Card, Macys American Express® Card, Macys Star Rewards program (including how card benefits relate to program status), fees and inconveniences, online account management, and more. Macys Credit Card Silver Membership Gold Membership Platinum Membership Key Benefits Star Money Days (Earn points with Star Money) 25% OFF (every 1 day of your choice) Benefits & Deals (Additional savings, invitations to events, etc.)

You’ll also get 25% off semi-recurring Star Pass vouchers that can be used on top-brand items and beauty products on rare sales. You’ll also get a 25% Star Pass discount on top brands, beauty products and fragrances that are almost never on sale. You can use it to shop at Macys and earn reward points called Star Rewards, which give you discounts on future orders.

With the Macys American Express(r) card, you get the same great benefits as with the Macys credit card, plus it can be used in millions of places around the world where American Express(r) cards are welcome. The most important detail to remember is that the Macys American Express Credit Card offers the same rewards as the Macys Store Card, but also offers the added ability to spend and redeem points at the gas station, grocery stores, restaurants and everywhere else. While the Macys Credit Card offers ample savings opportunities, the Macys American Express Credit Card is an even better option for consumers who want all the benefits of a store credit card, plus 3% at restaurants, 2% at gas stations and grocery stores. and 1% on all other expenses.

If you’re unsure if you’ll be buying enough from Macys to pay off a store credit card, Select recommends finding a redemption card that allows you to apply your points to any spend and make the most of your rewards. If you are determined to earn useful points for shopping at Macys stores, use this card specifically for all restaurant, gas station and supermarket purchases.

Also consider the pros and cons of spending at least $1,200 a year on Macys purchases to reach platinum status and get 5% store rewards or $500 in free shipping and 3% returns. If you want to get the most out of this card, your goal should be to spend at least $1,200 a year with Macys so you can reach platinum status and earn 5 points for every $1 you spend at Macys. Note that if you don’t have a Macys credit card, you can join the loyalty program as a “Bronze” member and get a 1% bonus.

The rewards you earn are only valid for Macys purchases, excluding gift cards, services and commissions. When you earn 1,000 Star Rewards points, you will automatically receive $10 Star Money, which you can only redeem at Macys, in stores, online, or over the phone. You will earn Silver Rewards status if you spend up to $499 per year on Macys. When you reach the Platinum tier, you’ll earn 5 points for every dollar spent on Macys, as well as cards with regular higher rewards at restaurants, gas stations, and supermarkets.

Once the card is approved, you’ll receive a 2-day coupon for 20% off up to $100 at Macy’s. While this is a nice bonus for a card with no annual fee, other cards offer bigger bonuses.

Most retail cards return between 3% and 5% with no minimum spend. If you spend a lot every year at restaurants, grocery stores, and gas stations, you can earn a significant amount of rewards with this card.

If you spend between $500 and $999 per year, you’ll get 1.5% back on purchases at Macyas stores and 1% back on purchases outside Macyas. If you spend $1,200 a year on Macys and automatically become a Platinum member, you’ll get additional benefits like 5% cash back on Macys purchases, free shipping, and special discounts. These two cards allow you to earn up to 5% in Star Money rewards on every Macy’s purchase, depending on your loyalty status. Insider Tip If you have a regular Macys credit card (review), you may be prompted to upgrade to that card, or you may be automatically upgraded.

In addition, every year on your birthday you receive a “surprise” provided you have used your card to make purchases at Macys (in-store or online) in the last 12 months. When you shop on Macys with a Macys credit card, you automatically get free standard shipping with no minimum purchase requirements. Rewards cannot be used for gift cards, Macys Beauty Box subscriptions, or services such as modifications.

Your rewards will not expire if you use your card at least once every 12 months. Also, when choosing a card, keep in mind the spending requirements as you will have to spend the required amount each year to keep the card. In addition to meeting credit standards, in order to qualify for one of these cards, you also need to meet spending limits.

Although there is no annual fee for this card, the Macys American Express card is not recommended for one-time buyers (those who spend less than $500 per year on Macys). While regular store cardholders receive special discounts on purchases and sales when using the card, they are not eligible for the Star Rewards program, where you actually earn rewards for purchases. And, just like with the Macys Basic Card, those who qualify for the Macys American Express(r) Card are automatically enrolled in the Silver Reward Program (again, more on status upgrades, benefit differentials, etc.) .

No matter how you use it, the Macys Credit Card can help you get the most out of every purchase by earning Star Rewards and Star Passes. Find out more ways to save with the Macys Sales Calendar and our updated Macys Coupon Collection.

In general, the average Macys shopper would be better off with a credit card that offers department store perks, such as a US bank’s Cash + Visa Signature card. On the other hand, if you buy Macys often, you might like what this card has to offer.

Avoid using this card when traveling overseas as it charges a 3% fee every time you make a transaction outside of the US. Honest or best credit required. If your credit is good enough, you will be approved for both cards and can choose which one you want. However, if your credit isn’t good enough to qualify for an American Express card, you may still be approved for a Macys credit card. You will first be considered for the American Express version (which usually requires a fairly excellent credit score), and if you do not qualify, you will be considered for a standard Macys credit card.

In addition to using the app to browse products, make purchases, request discounts and more, the Macys app can be used to manage your credit card and Star Rewards.

Last Updated on March 30, 2024

URL: https://log-in.me/credit-card/macysamericanexpresscard/