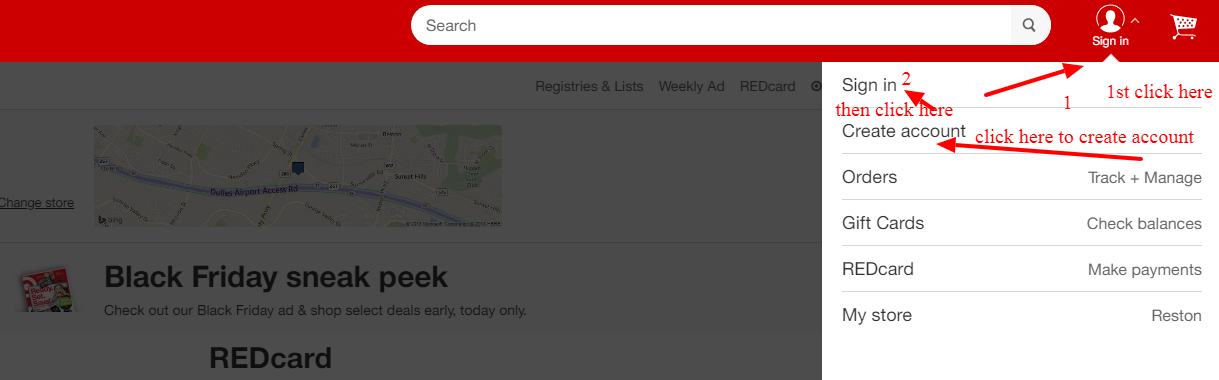

You will find the login to your red card account with Target RedCard by logging in to their website https://www.target.com/ – The log in box is in the upper right corner of the page under sign in. Click on Sign in and then again click on sign in when a window opens, enter your user name and password for your red card and login to your account.

You can create an red card account by clicking on Sign in upper right corner and when a window opens, click on create an account and you will be able to create an account in a few minutes after filling your data with Target RedCard.

The benefits of using a red card from Target RedCard

Below you will find a list of some of the benefits of using a red card from Target RedCard in your daily life. Do check their website for updated information of current offers and benefits.

- Use the red card at any Target store or online at Target.com

- Save 5%* on every shopping trip

- Free standard shipping on Target.com – minimum purchase threshold may apply

- Get 30 extra days for returns

- Enjoy RedCard early access events & exclusive offers

- Receive a 10% off storewide coupon* via email on your RedCard anniversary (redeemed in store only)

- Manage your card online using Manage My RedCard

Restrictions apply. Visit the RedCard page for more details. Early access offered for select events, products and promotions. Some early access and exclusive extras may not be available to all RedCard holders. Visit the RedCard page for more details. Exclusions apply.

The primary cardholder will be sent an offer via email after the card opening anniversary date. To qualify for the offer the primary cardholder must be signed up for marketing emails from Target and the card must be open and in a good standing.

The Difference between a Target.com account and manage my RedCard

A Target.com account is used to manage your online orders and registries, while Manage My RedCard is used to manage your Target Credit Card, Target Debit Card and Target Mastercard, including paying your RedCard credit red card bill, setting alerts, viewing transactions and updating your personal information. Visit RedCard page for further details http://www.target.com/

About Target RedCard

The Target RedCard does not offer rewards, points, or refunds on purchases. The Target red Card is a great option for shopping at the Target store, but the red card is not accepted outside of Target. We also recommend using a red card that will give you cashback and rewards when you shop at other stores, restaurants, online or anywhere. Cardholders will receive a 5% discount on eligible Target purchases when paying with a card.

5% off, which is more than you’ll find with any other credit or debit card, not even taking into account the store’s other perks. If you use your card responsibly and don’t make the RedCard mistake, this is a great way to save on every Target purchase.

This card has no signup bonus, has a surprisingly high APR, and only offers the benefits of Target. It’s best to get a separate card for other purchases, such as the Citi(r) Double Cash Card, which offers 2% on every purchase with an unlimited 1% refund at the time of purchase, as well as an additional 1% when paying for those purchases. , or the American Express Blue Cash Preferred® card, one of the best grocery credit cards if you’re shopping at a traditional grocery store. REDcard might be the obvious credit card choice for people who shop regularly at Target and want a discount on all their purchases.

Target RedCard offers consumers the choice of a credit card—for targeted purchases only—or a credit card with the Mastercard logo—as long as Mastercard is accepted, they can make purchases. When you pay with your REDcard, you can also get special gift cards, convenience store subscriptions, Shipt purchases (excluding membership fees) and discounts at Starbucks at Target stores. Target RedCard features and benefits include 5% off your purchases at Target, no annual fee, and an additional 30 days of returns and exchanges. The Target RedCard gives loyal customers the opportunity to save 5% on their purchases, or even more if they’re looking for discounts on Target Circle and Target subscription services.

While Target offers a 5% discount on purchases, other credit cards offer refunds, where the credit card issuer refunds the cardholder a percentage of the purchase amount. The Target REDcard automatically offers 5% off most Target purchases at the point of sale (online or at checkout), subject to some important limitations and restrictions. Discounts don’t actually apply to every Target item you buy. For example, when you sign up to receive essentials through Target’s subscription service, you can save 5% on service usage and 5% on card usage, for a total discount of 10%.

Target RedCard is issued as a store credit card or as a credit card with the Mastercard logo. The Target Credit Card, or RedCard for short, is a red credit card that can be used at Targets stores and on the store website. Target RedCards and debit cards are private label or closed-circuit cards, which means they can only be used in Target stores and online through the Targets website. Unlike your regular cash back card, the Target RedCard ™ does not generate rewards for purchases that you need to use in the future.

Also, Target RedCard(tm) is not offering any April introductory deals like zero interest credit cards do in April. REDcard users are also eligible for extended return windows on most Target purchases – an additional 30 days to decide if they really need something. Select spend type REDcard will earn 5% Bonus Savings for a total of 10% of the sticker price.

RedCard holders may also receive exclusive additional services based on their previous purchases or geographic location. Key exclusions include all retired items, Target Mobile purchases, and items with pre-set return dates.

One of the exclusive offers is to get a 10% coupon on the anniversary of the opening of the card if you subscribe to the Target mailing list – double daily savings. Cardholders receive a 10% discount coupon on their purchase in the year of the anniversary of the account when signing up for targeted marketing emails. Target may offer promotions for free shipping using modern shipping methods, and the terms of these promotions will be described in the offer.

The extended return period does not apply to Target Optical ™ purchases and non-returnable items. Cardholders receive an additional 30 days to return purchases on top of the standard 90-day return policy. If you purchase an item at a Target store or online with a REDcard, you get an additional 30 days to return the item in excess of the standard return policy window allowed for that item. While the 2% unlimited cashback rate is less than the 5% discount offered by REDcard, these cashback rewards can be earned on purchases anywhere, not just at Target.

However, CVS now operates all of Target’s pharmacies and this specific RedCard reward is no longer valid. And the Kohls payment card usually offers a 35% discount on the first purchase of the card, no minimum is required.

Plus, because the Target Prepaid REDcard is sponsored by American Express, you also get benefits like Purchase Protection, Roadside Assistance, Global Assist(r)5, and Entertainment(r). The third version, the Target Mastercard, which you can use outside of Target, is not open to new applicants, but some credit card holders may be targeted for upgrades. Unlike most store cards, Target allows you to request two different versions of the RedCard. Since Target offers store credit cards and traditional Mastercard credit cards, you can apply for the credit card that suits your needs.

Most of them are owned by major payment networks such as Visa, Mastercard and American Express, so their use is not limited to one retail ecosystem – the RedCard debit card. Notable exceptions include restaurants (other than Starbucks) at targeted stores, prescription and healthcare services at targeted pharmacies, targeted gift and prepaid cards, and gift wrapping.

Alternatively, if you don’t spend very often on Target, there’s probably a better return card for you. In any case, when deciding if a REDcard is right for you, consider how often you shop online at Target or Target and how much you can potentially save by getting a 5% discount each time. If you shop frequently at Target, this $0 annual red card can be an easy way to save money on daily purchases like groceries and household items. As long as you use the card as intended and keep the associated bank account open, it is unlikely that you will ever pay a usage fee.

On the plus side, you don’t have to go through a credit check (which can temporarily lower your credit score) when applying for this card. Never use any card details other than your own to make a payment.

Last Updated on January 21, 2024

URL: https://log-in.me/credit-card/targetredcard/