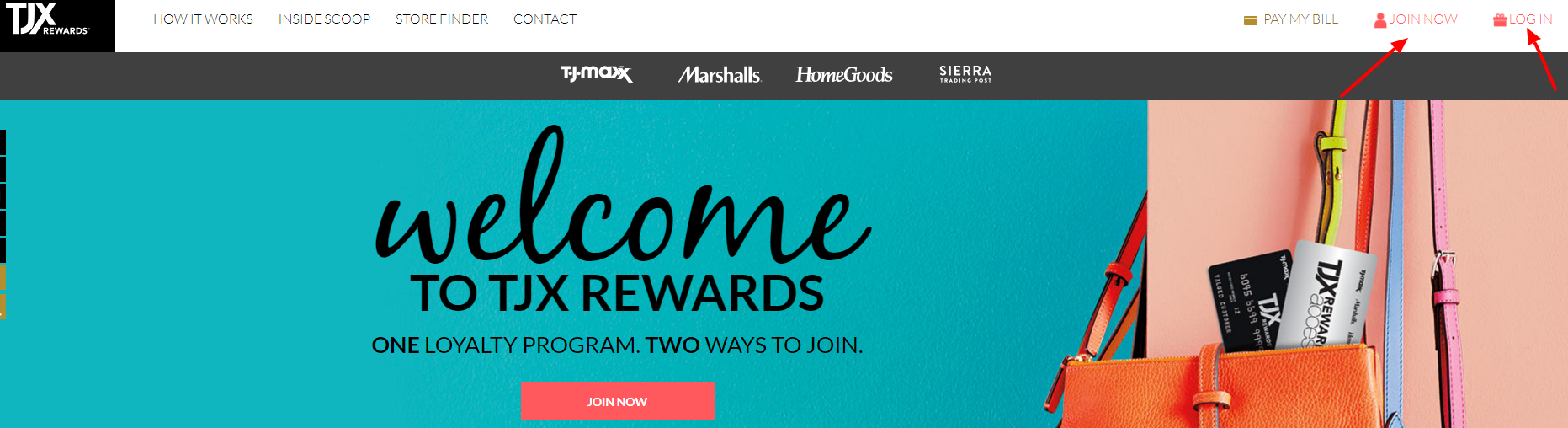

You will find the log in to your account with TJX Rewards® Credit Card by logging in to their website. The log in box is in the upper right corner of the site, under login, enter your username and password and sign in to your account. You can register an account just by clicking on join now, which is located beside the login box of TJX Rewards® Credit Card.

The TJX Rewards Credit Card can give you good savings at TJ Maxx, Marshalls, HomeGoods and Sierra stores but not much else. For purchases outside of these stores, most consumers will be better off sticking to a cash back credit card like the Chase Freedom or the Citi Double Cash Card.

You need fair credit to get approved for the TJX credit card, which means a credit score of 620 or above.

TJX Rewards® Access is a loyalty program that gives you exclusive access to members-only sweepstakes and shopping events, shipment arrival alerts and other special offers.

The TJX Rewards Credit Card typically approves applicants with fair credit or better, which means credit scores around 620 or higher. You can apply for a new card at any TJX-branded location, including your local T.J. Maxx.

TJX Rewards certificates can be used at tjmaxx.com, sierra.com, or in any T.J. Maxx, Marshalls, HomeGoods or Sierra store. To redeem online, enter the 19-digit certificate number and 4-digit CSC in the payment section of checkout.

Since T.J.Maxx, Marshalls and Homegoods belong to the same parent company, each store will accept another’s gift card. Browse the three brands to find which one offers the best deal. Right now at Gift Card Granny, you can save up to 8% on a Marshalls, HomeGoods or T.J.Maxx gift card. you cannot make a payment on your T.J. Maxx TJX Rewards Credit Card in-store, according to the card’s terms and conditions. Payments can be made online, by mail, or by phone. Free shipping online from both T.J. Maxx and Sierra Trading Company with no order minimum.

About Tjx Rewards Credit Card

You can earn a flat rate reward for every purchase you make with a credit card, such as the Citi Double Cash credit card, which rewards 1% on all purchases, as well as another 1% refund on checkout. your account, for a total of 2% cashback. With Citi Double Cash, Discover it, and Chase Freedom, you can redeem your rewards for cash, gift cards, and more than just TJ Maxx purchases. Savvy shoppers who frequent TJ Maxx for great deals can save even more with the TJX Rewards card issued by Synchrony Bank.

Store Supporters can apply for the TJX Rewards® Credit Card, available through Synchrony Bank, which allows you to earn rewards at TJX Home Stores, including T.J. Maxx, Marshalls, HomeGoods, Homesense and Sierra. The TJX Rewards® Credit Card helps you earn 5 points per dollar and 1 point per dollar anywhere in the US at TJMaxx, Marshalls, HomeGoods, Sierra and Homesense stores and participating e-commerce sites operated by these brands. The card also offers an initial 5% bonus on Walmart store purchases when using Walmart Pay for the first 12 months. The card allows you to earn 5% back in rewards categories per quarter of activation, up to $1,500.

This reward rate means you earn five reward points for every dollar spent using your card in T.J. Maxx or other TJX store. When you accumulate 1,000 points, you can redeem them for a $10 purchase certificate valid for in-store or online purchases at TJX stores. Whenever you earn 1,000 points, they can be redeemed for a $10 rewards certificate that can be used on cards from any partner brand. Points earned are used as reward dollars, which can be redeemed for a credit statement, gift card, or used for purchases at Amex-affiliated outlets.

And there is no limit on the number of bonus points you can accumulate on your card. After all, if you need a card that you can use to redeem rewards at your favorite TJX retailers store, both cards do the job equally well. If you want more ways to redeem your rewards, the traditional redemption card is your best bet.

For example, some of the best cash back credit cards typically reward you $150 to $200 after you spend $500 to $1,000 on the card within the first three months of your card subscription. Even if your first store purchase is $500, you’ll only get $50 off. However, if you’re applying on a desktop or tablet, you can use the discount online or in-store.

You also spend an additional $500 per month on miscellaneous purchases with your card. Based on the household expenses above, if all purchases were paid with your QuicksilverOne card, you could earn $396.15 in cash every year. Although the initial deposit may seem high, there is no annual fee with this card.

Get 10% off your first in-store purchase with your TJX Rewards Card after account opening. One of the unique benefits of owning a TJX Rewards Card is access to special discount opportunities, such as exclusive personal shopping events. .This includes rewards for TJX purchases and purchases made elsewhere. In addition to the TJX Rewards Card Rewards, the TJX Rewards Platinum Mastercard offers the same 5x rewards on qualifying purchases and can be earned on every $1 spent on qualifying purchases wherever Mastercard is accepted 1 point.

Also, in addition to earning a 5% reward on every TJX purchase you make with one of the TJX Rewards(r) cards, your TJX Rewards(r) Platinum Mastercard(r) card can earn you 1% on any a purchase not related to TJX. you do with your card. But while the TJX Rewards® credit card can only be used in TJX stores, the TJX Rewards® Platinum Mastercard® gives you the freedom to use a credit card worldwide (and no fees for transactions abroad). With a platinum card in your wallet, you can make payments wherever Mastercard is accepted.

These cards offer more flexible spending options as well as the ability to earn cashback that you can use anywhere. As part of the Blue Cash Everyday introductory offer, new card members can earn $150 in cash by spending $1,000 on purchases within the first three months. With retail store bonus cards, you can often get a discount on your first purchase, rather than the usual introductory bonus offer.

Maximizing your rewards with the TJX Platinum Rewards Mastercard means shopping at the TJX store whenever possible. Before applying for the TJ Maxxs credit card, you should check out Universal Cards, which offer greater spending flexibility and great rewards programs. If you frequent the T.J. Maxx client, you can use T.J. Maxx credit cards to shop at T.J. Maxx, Marshalls, HomeGoods, Sierra Trading Post, and Homesense are all brands in the TJX store family.

Benefits include online and in-store discounts, certificates and exclusive shopping promotions. And the 5% return rate on TJX purchases is higher than what you can get with many return cards. To put that into perspective, you have to spend $200 at the TJX store to get 1,000 bonus points based on a 5% return rate.

With both cards, you can earn the same rewards at the TJX Family Store and make the same variable purchases throughout April. These two cards give you more freedom to earn bonus rewards as a new cardholder, and don’t limit your spending to TJ Maxx stores to use it.

If you have received this card, you should never use it for your monthly balance. Earn the same 5% at TJX stores and get 10% off your first purchase. And neither card charges an annual fee, and the Mastercard version doesn’t charge foreign transaction fees. Instead, cardholders can only use reward certificates obtained exclusively from TJX family stores.

The rewards you get when you buy from T.J. Maxx would have had much more flexible and potentially advantageous repayment options without annual fees. If you’re looking into store credit cards, consider the Target RedCard(tm)* credit card, which gives you a 5% discount on Target in-store or online purchases, including discounted items, gift cards, recipes, and in-store Starbucks.

In addition, many premium credit cards include 0% APR on both purchases and balance transfers, which can save you money when transferring and paying your balance to another card with a high APR. If your credit score is higher and you qualify, you can almost always earn more rewards and save more with credit cards like Discover it, Citi Double Cash and Chase Freedom. If your credit score is 670 or higher, you might be better off with one of the best cashback cards like Chase Freedom Flex.

Also, if your first purchase is large enough to qualify for a 10% discount and you’ve had credit issues in the past, the TJ Maxx Store Card may be your best bet. If you apply for Platinum and are not approved, you may be offered a store card instead.

Last Updated on June 15, 2022

URL: https://log-in.me/credit-card/tjxrewardscreditcard/