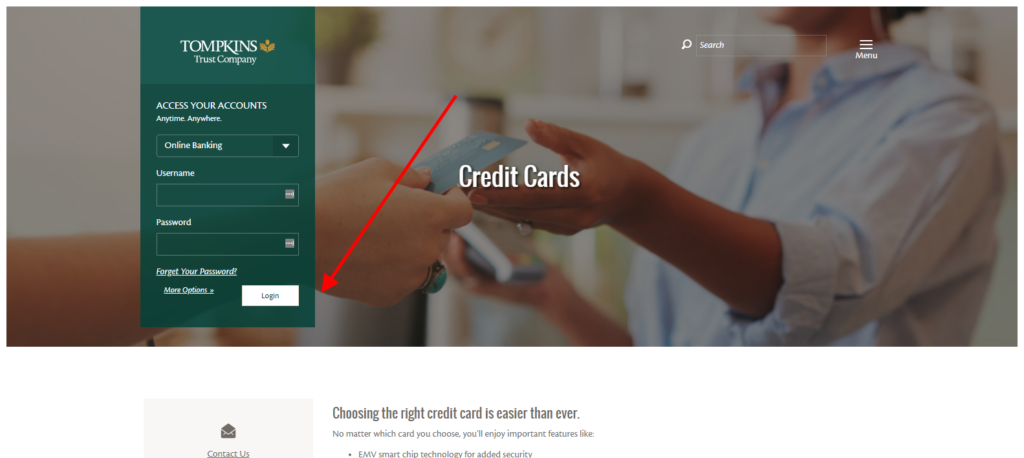

You will find the login to your account with Tompkins Trust Company Visa® Business Bonus Rewards Card by logging in to their website:

- https://www.tompkinstrust.com/personal-banking/loans/credit-cards

- The login box is in the link provided above, the login is in the upper side left corner of the site, is where you will see where you enter your login details of Tompkins Trust Company Visa® Business Bonus Rewards Card.

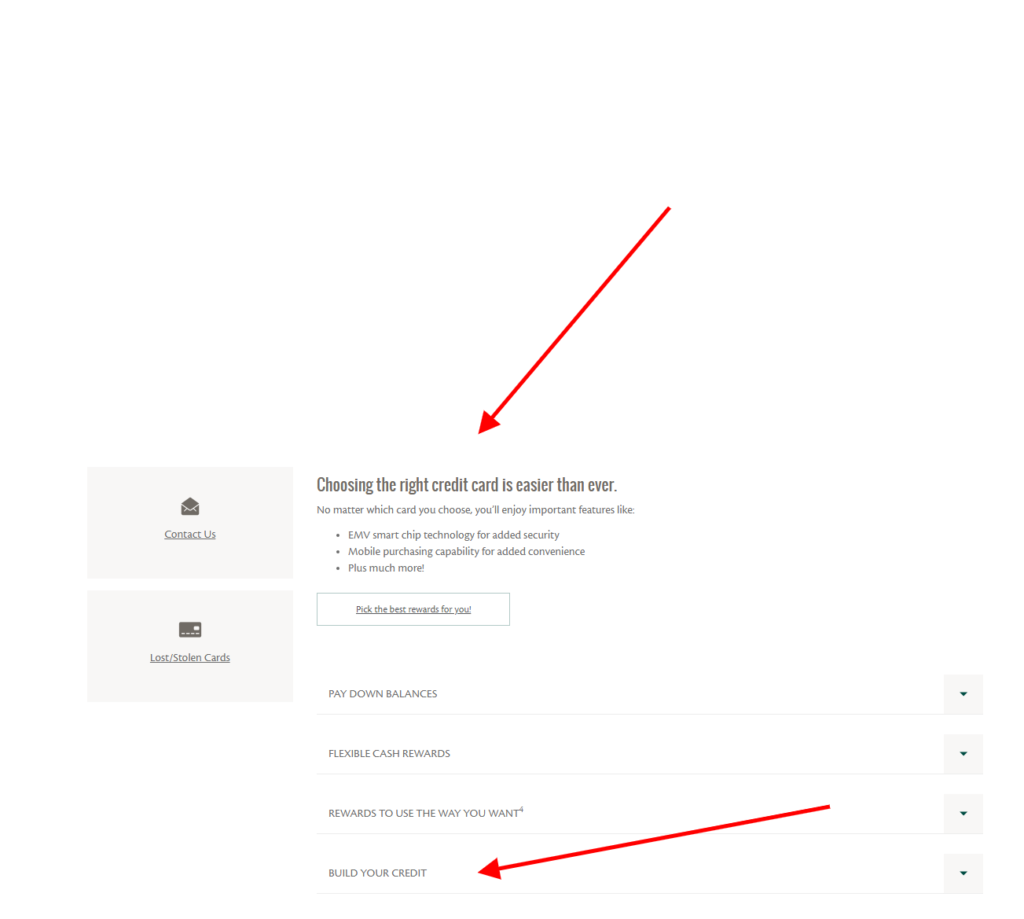

- You can register an account, select whether to open an account or to apply for a master card or any other service. Tompkins Trust Company Visa® Business Bonus Rewards Card has information under each product and service and guidance links on their requirements and filling the forms online. Check the following screenshot.

Reward points can be redeemed as a cash deposit to a checking or savings account with this Financial Institution or as a statement credit to your credit card account within one to two billing cycles.

Cash Rewards Card: “Cash Back Rewards” are the rewards you earn under the program. Cash Back Rewards are tracked as points and each point in Cash Back Rewards earned is equal to $0.01. You may simply see “Cash Back” in marketing material when referring to the rewards you earn. You will earn 1 Reward Point (“Point”) for each dollar of eligible Net Purchases charged to your Account during each billing cycle. You will also earn 1 additional Point (for a total of 2 Points) for each dollar of eligible Net Purchases charged to your Account during each billing cycle for any merchant classified as a supermarket. The number of additional Points earned on supermarket Purchases is unlimited. In addition, you will earn 2 additional Points (for a total of 3 Points) for each dollar of Net Purchases charged to your Account during each billing cycle at merchant locations that are classified in any of the following merchant category codes:

automated fuel dispensers and service stations, up to a maximum of $6,000 spent during each 12-month period commencing on the anniversary date of this Account. Automated fuel dispenser and service station purchases above $6,000 (for the remainder of that 12-month period) will earn at a rate of 1 Point for each dollar of Net Purchases charged to your Account during each billing cycle. Points expire five years from the end of the quarter in which they are earned.

Bonus rewards points or cash back will be applied 6 to 8 weeks after first purchase and are not awarded for balance transfers or cash advances. One-time bonus rewards will be awarded after eligible net purchases totaling $1,000 or more are made to your account within three months from account opening.

The Elan Rewards Program is subject to change. Rewards are earned on eligible net purchases. Net purchases are purchases minus credits and returns. Not all transactions are eligible to earn rewards, such as Advances, Balance Transfers and Convenience Checks. Upon approval, see your Cardmember Agreement for details. You may not redeem Points, and you will immediately lose all of your Points, if your Account is closed to future transactions (including, but not limited to, due to Program misuse, failure to pay, bankruptcy, or death).

Real Rewards: You will earn 1.5 Reward Points (“Points”) for each dollar of eligible Net Purchases made with your Account within a billing cycle (equal to 1.5% cash back). Monthly net purchase points will be applied each billing cycle. Points expire five years from the end of the quarter in which they are earned.

Premier Rewards Card Points: You will earn 1 Reward Point (“Point”) for each dollar of eligible Net Purchases charged to your Account during each billing cycle. You will also earn 1 additional Point (for a total of 2 Points) for each dollar of Net Purchases charged to your Account during each billing cycle at merchants which categorize their business as a service station or automated fuel dispensers. You will earn 2 additional Points (for a total of 3 Points) for each dollar of Net Purchases charged to your Account during each billing cycle at merchant locations that are classified in the merchant category code of airlines. You will earn 3 additional Points (for a total of 4 Points) for each dollar of Net Purchases charged to your Account during each billing cycle at any merchant classified as a restaurant. Points expire five years from the end of the quarter in which they are earned.

Certain limitations and restrictions may apply. Further details are available in the Guide to Benefits which is provided to new cardmembers upon approval.

Late payments and going over the credit limit may damage your credit history. The creditor and issuer of these cards is Elan Financial Services, pursuant to separate licenses from Visa U.S.A. Inc. and American Express. American Express is a federally registered service mark of American Express.

Last Updated on October 22, 2019

URL: https://log-in.me/credit-card/tompkinstrustcompanyvisabusinessbonusrewardscard/