How to login to my account with Eurobank Ergasias?

You will find the log in to Eurobank Ergasias, Athens, Greece by log on to their website https://www.eurobank.gr/en/group/grafeio-tupou/159-news-page

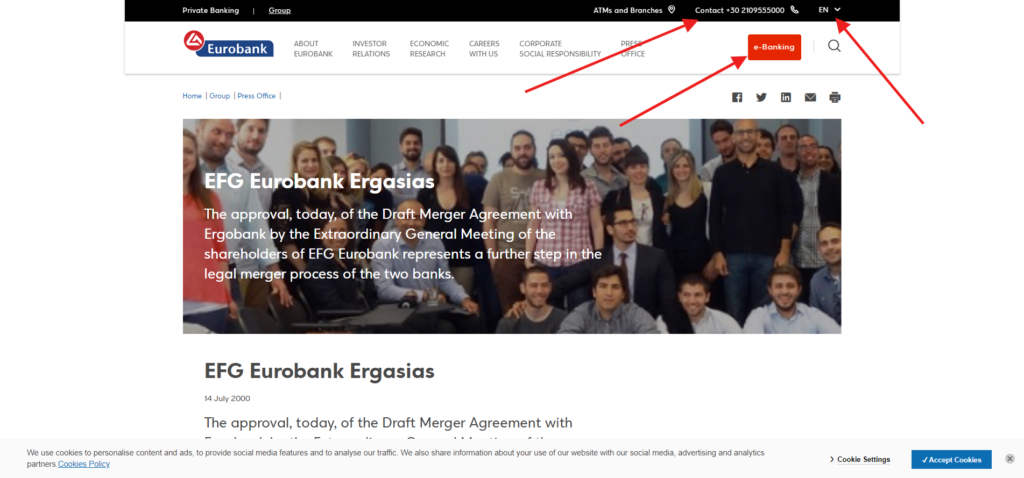

The log in box is in the upper right corner of the site, just click on E-BANKING then enter your username and password and login to your account. You can switch to English language on the website, by clicking on EN which you’ll find on the upper right side of the login page.

Bank online with e-Banking and carry out more than 1.200 fast and secure transactions at lower rates. Manage your products 24/7 from your computer, mobile phone or tablet. Use interactive visuals to monitor your finances easily. Opt to get a consolidated view of your products with Eurobank and other banks if you enable the connection.

Sign up online to e-Banking from your computer or mobile phone with the number and PIN of your debit or credit card.

Carry out over 1.200 transactions with e-Banking. Log in any time 24/7, even on weekends and public holidays.

All your products with Eurobank and other banks in Greece appear on your dashboard. Smart charts enable you to monitor them easily.

You get lower fees compared to other ways to bank. You can also use e-transactions to save even more when you carry out transactions. Use Cards Control free of charge to manage your cards straight from your computer or mobile, without coming to a branch.

Many of the purchases and payments you make online with e-Banking count towards your tax deductions.

Carry out fast transactions in many ways. Create favorite transactions to carry them out again at your convenience.

Get banking products straight from your computer, without coming to one of Eurobank branches.

Your transactions are carried out within a secure electronic environment with advanced Firewall and encryption protocol.

Do you need help to sign up online to e-Banking? Call Eurobank dedicated customer service line: +302109555710, Monday to Friday 09:00-17:00 Alternatively, come to one of Eurobank branches.

Last Updated on June 9, 2022

URL: https://log-in.me/eurobankergasias-athens-greece/