First National Bank was established in September 1905 and headquartered in Camdenton, Missouri. The bank operated as a subsidiary of First National Bancshares, Inc.. First National Bank was classified as a commercial bank, national (federal) charter and Fed member, supervised by the Office of the Comptroller of the Currency (OCC). First National Bank is no longer doing business under that name. To view branches, routing numbers, phone numbers and business hours; you can check Oakstar Bank page https://www.oakstarbank.com/

How do I login to my account with Oakstar Bank ?

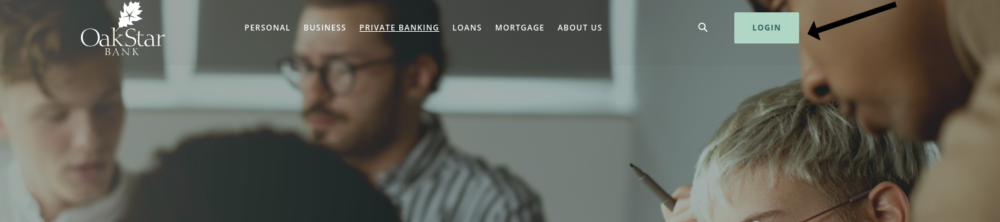

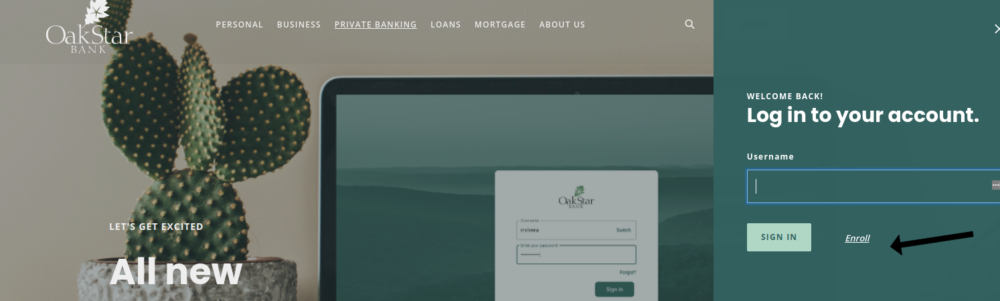

To login to your account with Oakstar bank, go to their website’s home page https://www.oakstarbank.com/ the login is located in the upper right corner of the home page. Click on login, enter your username, password and login to your account with Oakstar bank.

Meantime, if you would like to register an account to get access to online banking services with Oakstar bank, all you need to do, is to repeat the same step for log, then click on Enroll. You need to have your social security number, your account number, your email and phone number to fill the requested data. Just follow the few steps online and when you are done, submit it for approval.

Oakstar Bank was established in 2005 and is headquartered in Springfield, Missouri. OakStar Bank operates banks in Springfield and Bolivar, with a mortgage center in Kansas City and a loan office in central Florida. It is a traditional bank with physical access to support representativesو in addition to online and mobile offerings. The Bank of Urbana has 48 employees at its headquarters in Urbana and branches in Buffalo, Hermitage and McCreek.

Opened in 1903, Urbana Bank serves clients in Buffalo, Hermitage, Mark Creek and Urbana. Its subsidiaries currently have more than $1.3 billion in assets and have operations in Springfield, Joplin, Bolivar, Buffalo, Urbana, Hermitage, Mark Creek, Camdenton, Sunrise Beaches, Osage Beach, Lake of the Ozarks, Clinton, Missouri, and Overland Park operate community banking centers. .The branch provides a full range of banking services to individuals and legal entities. The company is powered by a commitment to public banking and a strong board of directors.

The transaction has been approved by the boards of both banks and is subject to regulatory approvals. The boards of both banks have approved the merger. OakStar Bancshares have more than $1.5 billion in assets, 19 full-service bank branches, mortgage lending offices in Kansas City, loan origination offices in Columbia and the Knicks, Missouri, an operations center in Springfield and approximately 330 members. Order. Under the terms of the merger agreement, OakStar Bancshares acquires First Bancshares and its subsidiary Community First Bank (Kansas City, KS), a Kansas State Bank with approximately $225 million in assets.

Over fifteen years, with 15 branch expansions in Missouri, five of which were acquired in Lake Ozark, OakStar volunteered to retain as many employees as possible from these newly acquired banks. OakStar has amassed a variety of personal and business accounts at previous banks, doing its best to retain as many past clients as possible while continuing to grow in the community. Both exceeded their customer retention goals, according to OakStar management and former bank employees.

Among the various branches, OakStar sought to make it more attractive and customer-focused, including bank branches so that people can interact side by side with bank employees. The original goal of OakStar Bank was to create a more personalized and unique banking experience tailored to the specific needs of the region in which it is located.

Oakstar Bank offers a full range of banking products including savings accounts, checking accounts, money market accounts, CDs and mortgage products. The Oakstar Bank mobile app allows you to manage your accounts by checking monthly statements, sending and receiving funds, and contacting support representatives. Opening a checking account with no monthly fees and a savings account with a high interest rate at the same bank is the best way to get the most out of your deposits while still having easy access to your money.

At an Oak Bank ATM, you can deposit or withdraw money with your Oak Bank MasterCardTM or Check Card without any fees. Oak Bank has partnered with other participating community banks throughout Wisconsin to offer you free ATM cash withdrawals at ATM access terminals statewide. Protect your account with a 4-digit passcode and fingerprint or face scanner on supported devices.

Assistance with online banking issues, as well as the creation of new online banking profiles. Basic knowledge of relevant state and federal bank compliance regulations and other operating policies of the Bank. Basic experience, knowledge and training in the work of branches, terminology, products and services.

Ensures compliance with all Bank policies and procedures and all applicable state and federal banking regulations. Follows policies and procedures; carry out administrative activities correctly and on time; supports the goals and values of the Bank; benefits the bank through external activities. The cashier position is responsible for performing the normal operations of the branch and customer service; accepts retail and commercial checks and savings deposits; processes loan payments; cashier’s checks and savings withdrawals; promotes the Bank’s business by maintaining good relations with clients and referring clients to the right personnel for new services.

Cross-selling other products and services to banks by referring customers to the appropriate personnel as indicated. Work experience must consist of experience in cash management and/or customer service.

Oak Star Bank received an excellent consumer satisfaction rating due to the relatively low number of consumer complaints filed with the government-backed consumer protection agency, the Consumer Financial Protection Bureau (CFPB). Moovit makes it easy to access Oakstar Bank operations, which is why over 930 million users, including Springfield commuters, trust Moovit to be the best public transit app. Moovit provides free live maps and directions to help you navigate the city.

List of all branches of Oakstar Bank and details of branches such as opening hours, telephone number and address; Refine your search by selecting a location on the map or list.

Long-term growth in deposits shows the ability of banks to raise capital to increase loans and assets. Capitalization measures the amount of equity a bank must maintain on its balance sheet for loans and other assets. The Texas Ratio compares Oak Star’s non-performing assets (non-performing loans and owned real estate) to its actual equity and loan loss provisions. Fees Fee levels are estimates of bank fees based on national averages for certain services and also depend on whether banks refund ATM fees.

Last Updated on June 8, 2022

URL: https://log-in.me/firstnationalbancshares-camdenton-unitedstates/