How to login to my account with First of America bank?

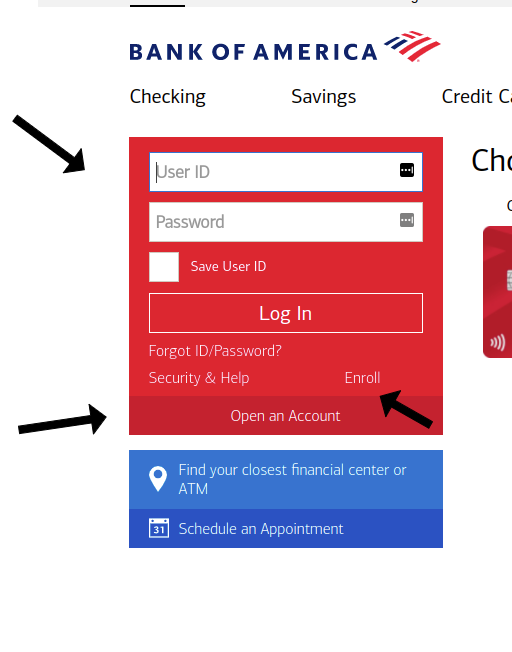

To login to your account with First of America bank, visit their home page https://www.bankofamerica.com/ the login box is located in the left upper corner of the home page, enter your user ID, password and login to your account.

How to register an account with First of America bank?

To register an account with First bank of America, click on the Enroll, which is located at the bottom of the login box, upper side of the home page, left corner, Enter your card of account number, Social Security Number (SSN) or Tax ID Number (TIN), then click continue and go with the process online, after you are done, submit the form for approval.

How to open an account with First Bank of America?

Open an account that fits your needs, From setting up a checking or savings account to finding the right home loan, Bank of America can help.And for your investment needs, Merrill offers online tools and resources to help you take control of your finances. Click on the service/product you need, and go with the process online.

The President, Directors and Corporation of Bank of America, commonly known as the First Bank of the United States, is the national bank established by the United States Congress on February 25, 1791, for a twenty-year term. The First Bank of America, now commonly known as the First Bank of America, opened in Philadelphia on December 12, 1791, with a 20-year franchise. After the First Bank of America card expired in 1811, Stephen Gillard purchased most of his stock as well as the First Bank building and its furniture on South Third Street in Philadelphia and opened his own bank, which came to be known as Gillard Deutsche Bank. . America’s first bank was established in Philadelphia, Pennsylvania, which was the capital of the United States from 1790 to 1800.

The First Bank of Nations is privately owned, not a public institution, it used to be a business. In addition to acting on behalf of the government, the Bank of the United States also acted as a commercial bank, which meant that it accepted deposits from the public and made loans to individuals and businesses.

With the 1991 purchase of Bank of America’s main competitor in California, the Security Pacific Corporation, Bank of America became the first bank to offer inter-coast operations in the United States. The company expanded its credit card business by acquiring transaction processing company National Processing in 2004, and its merger with MBNA Corporation in 2006 made Bank of America the leading credit card issuer.

The $10 million capitalization made the Bank not only the largest financial institution, but also the largest company of any type in the United States of America. It made more loans and issued more currency than any other bank in the country because it was the largest financial institution in the United States and the only institution that held federal government deposits and had branches throughout the country. This was followed by the Bank of North America, the country’s first de facto national bank.

Although the third bank became a successful business worth about $300 million under Michigan law in 1970, it could not make acquisitions outside a 25-mile radius of Kalamazoo. Eight years later, the name of the third bank was changed again to First National Bank and Kalamazoo Trust Company to reflect the fact that a trust division had been added to its business. Throughout the 19th century, the First National Bank of Kalamazoo served the City of Kalamazoo by taking deposits and providing business loans and investments. The third bank became the holding company on March 20, 1972, and was renamed First National Financial Corporation through the acquisition of banks in Calumet and Deerfield, Michigan.

Perhaps its most significant out-of-state acquisition was made on November 1, 1989, when First of America acquired Midwest Financial Group of Peoria, Illinois, for approximately $250 million, or 5.6 million shares of First of America common stock, Inc.

First of America Bank Corporation offers traditional checking and savings programs, as well as a variety of other financial services, including mortgages, retail credit and investment opportunities, at 566 branches in Michigan, Illinois and Indiana. Maryland Seaport Bank originally opened in September 1982 to provide banking and other financial services primarily in the Baltimore metropolitan area. First Independent Bank has served the Detroit metro area for 50 years, beginning operations on May 11, 1970. First Independent Bank is the only African-American-owned bank headquartered in Michigan, and one of only two in Detroit.

Union Bank of Philadelphia was originally established in 1992 to provide personalized banking services to individuals and businesses in the greater Philadelphia area. Since opening the first branch of the First Bank* in 1935, First Bank has long been committed to providing the right solutions for financial success.

The Carver Federal Savings Bank was founded in 1948 to serve African American communities with limited access to traditional financial services. In 1934, after working closely with the Federal Home Loan Bank of Chicago, 13 African Americans formed the Hospital Management Credit Union to provide a savings and loan association for Chicago blacks. Prior to the lease of the first black-owned bank in 1888, the United States Congress and then President Abraham Lincoln established the Friedman Savings Bank in 1865. Black-owned banks did not exist until more than a century later. North America Bank of North America doors.

In 1791, the Bank of America was one of three major financial innovations proposed and supported by the first Secretary of the Treasury, Alexander Hamilton. Alexander Hamilton believes that under the newly adopted Constitution, the National Bank is necessary to stabilize and enhance the country’s creditworthiness and to improve the management of the country’s financial affairs. Such institutions ran counter to Thomas Jefferson’s view that America was a predominantly agricultural society rather than one based on banking, commerce, and industry.

In 1968, Bank of America was organized in Delaware as the holding company for Bank of America NT&SA and other financial branches. The bank also paid US Treasury interest to European investors on US government bonds. Every other bank in the country was leased out and allowed to have branches in one state.

Last Updated on June 8, 2022

URL: https://log-in.me/firstofamerica/