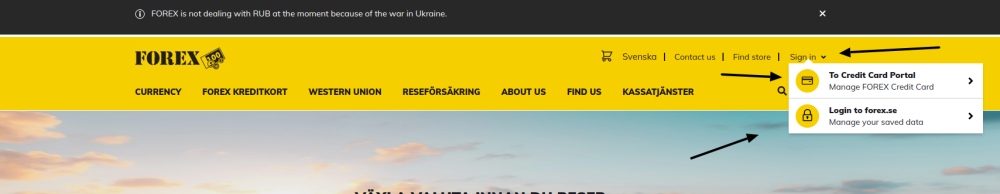

You will find the log in to Forex Bank, by log on to their website https://www.forex.se/en – The log in box is in the upper right corner of the home page. Click on Sign in. SElect whether to login to credit card portal or to forex.se, depends on type of your account with Forex Bank. Enter your user ID, password and sign in to your account with Forex bank.

The Forex Bank AB was founded in 1927, and up to the early 1990s was the only firm other than the Bank to have been licensed to trade currency with Bank of Sweden. In 2003, FOREX Bank expanded their operations to retail banking, where they are able to also offer current and savings accounts, including Internet and mobile banking, loans, debit cards and credit cards, cash management, and money transfers and payments. In addition to currency trading, FOREX Bank now offers a number of banking services that are highly competitive in Sweden.

International transfers with FOREX Bank can take longer than with private exchange providers, and you also will have to be a current FOREX Bank account holder in order to take advantage of FOREX Bank services. Sending foreign currencies into or out of a FOREX Bank account in Sweden does not have to be complicated, in fact, you could save both time and money by using a specialized currency broker instead. Save money in currency exchange rates when transferring money abroad from your FOREX Bank account into Swedish Krona, Euros, British Pounds & other currencies.

The drawbacks of transferring internationally using your bank When sending or receiving money using your bank, you may be missing out on an ugly exchange rate, and paying hidden fees as a result. Spending your holiday or international business trip waiting in lines at foreign banks or dealing with currency conversion headaches is not ideal. They are a cheaper alternative to buying money on your travels, as exchange bureaus and banks charge fees to convert currencies. Examples of such transactions include exchanges, withdrawing foreign currency from a bank account, making payments in foreign currencies, and selling and redeeming debts or other debts for foreign currencies.

Scenario 4A If the transaction is conducted in a currency that is not offered on the card, then the transaction will be processed debiting default currency (USD). Values in the default currency (USD) will be converted into the local currency using the Cross Currency Conversion Rates decided by the bank. If fixed rates are not available in any given currency, an average rate of conversion–between buy and sell rates at the date of transaction according to the official currency rates–may apply. If no exchange has taken place, then a fixed rate determined by Nasdaq Stockholm AB on every business day must apply.

Cancellation & Refunds – You can cancel a transaction at any of the Companys locations, or by calling Western Union Financial Services on 020901090*, until the receiver has collected the funds, or, in case of account-based transactions, until either the Company or Western Union has transferred the funds to the banking partner. Where Company or Western Union or its agents accept cheques, credit cards or debit cards, or other forms of payment not in cash, neither Company nor Western Union or its agents are obligated to handle a money transfer or to repay unless the transfer is in cash.

Company and Western Union Financial Services assume no liability for any fees, the exchange rates used for converting into non-local currencies, acts or omissions by any destination financial services provider or the facilitator. The service is offered by FOREX AB (company) in conjunction with Western Union International Limited, an Irish company, for all transactions (except for transfers from the United States, Canada, and Mexico, and transactions involving trade services, which are offered in conjunction with Western Union Financial Services, Inc., an American company) (together, Western Union).

Applying for a foreign exchange card is a fast and simple process, and a number of banks and financial institutions, and major travel agencies, offer these cards. When applying for a forex card with a bank, financial institution, or travel agency, there are certain criteria to be met before a card is issued. When applying for a forex card, it is recommended that you research on different cards offered by banks and other institutions. Banks, financial institutions, and travel agencies usually have a selection of cards that applicants can choose from, depending on what currencies are available for loading onto the card.

Card issuers also have foreign exchange cards offered only to preferred banking customers, or available only on an invitational basis. It is cheaper for banks to issue the forex cards, which results in better exchange rates for applicants. With preloaded forex cards, there is no need to find money-changing outlets at foreign locations. Since it is located within your neighborhood, you can give them the cash without using your bank card.

Well, I would say this is one of the only places where you will need to either use your foreign bank for your ticket purchase, or if you are like me, you have to go and take the tram towards central station, it is a nice area at the center of Gothenburg, it does not take you longer than 30-45 minutes walking from downtown. Once I arrived to my students apartment in Gothenburg, I realized it was going to be harder than I thought to get around without my international bank card or Swedish Kronor (SEK). You transfer money just as quickly as you can in the bank, often more quickly than that: Some currencies take just minutes. Most stores and businesses do not accept Euros and dollars here, although it is part of the European Union, it has its own currency.

In foreign currency exchange markets, SEK is an acronym of Swedish Krona, the Swedish national currency. In 1992, Sweden implemented a floating exchange rate for the SEK, which has been allowed to fluctuate relative to other currencies ever since, with the country’s central bank sometimes intervening to stabilize the SEK. Despite the relatively small size of the Swedish economy, the highly educated and technology-savvy Swedish labor force, as well as the fact that it is the headquarters of a number of transnational corporations, has led many Forex observers to rank SEK as a safe-haven currency.

Once the applicant has submitted all documents and received a currency card with PIN, he/she must change the assigned PIN and check the cards balance at the ATM at the issuing bank/financial institution.

Last Updated on June 8, 2022

URL: https://log-in.me/forexbank-stockholm-sweden/