How to login to My Account with Marin National Bancorp?

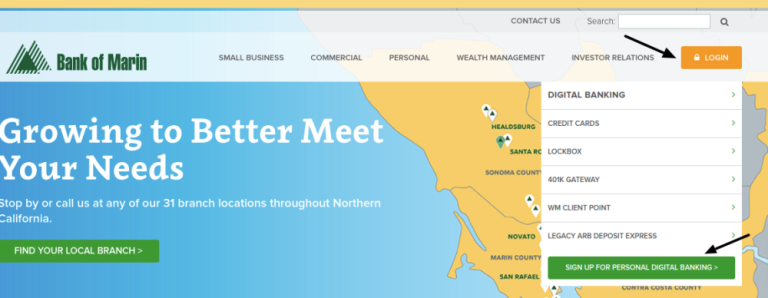

To login to your account with Marine National Bancorp, go to their website’s home page , Click on login which is located in the upper right corner of the home page. Choose the type of your account to login as it shows per the following screenshot. Enter your user id, password and login to your account with Marin bank.

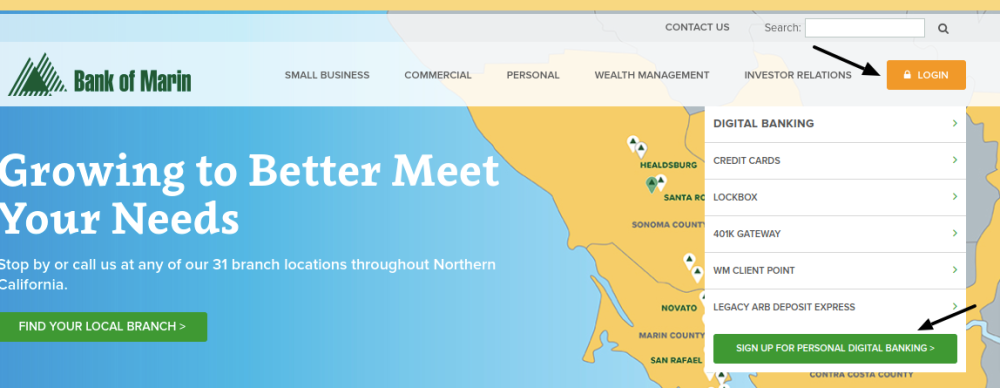

If you are already a client and you would like to sign up for digital banking services with Marin bank, click on SIGN UP FOR PERSONAL DIGITAL BANKING as it shows per the following screenshot. The sign up appears after you click on login box. Fill the form with the requested data, then submit online for approval.

Digital Banking questions and answers

What to do, if I have any problems in dealing with Marin Digital banking?

All you need to do, is to Contact Customer Support for assistance.

What to do if I forgot my password?

It is very simple, just click on the ‘Forgot Your Password’ link from the login page. If you are locked out, please contact Customer Support for assistance.

How to get started with digital banking?

For Personal Digital Banking enroll online by clicking the Login button as explained above, or visit any branch. For Business Digital Banking, visit any branch or contact Marin bank to find the best solution for your business needs.

Can Bank of Marin provide a digital banking guide?

Yes, please contact Customer Support if you are unable to locate on the website.

About Bank Of Marin

Dedicated to providing legendary customer service and investing in the local community, Bank of Marin has been recognized as a Top Corporate Philanthropist consistently by the San Francisco Business Times, as well as a Best Place to Work by the North Bay Business Journal. A leading business bank and community bank in Northern California, Bank of Marin Bancorp has $3.3B in assets, 31 retail branches, and eight commercial banking offices located throughout 10 counties.

Bank of Marin Bancorp operates as a holding company for Bank of Marin, which provides a range of financial services, primarily to small to mid-sized businesses, professionals, nonprofit organizations, and individuals throughout California, United States. According to the Federal Deposit Insurance Corporations records, and according to the types of institutions chartered, Bank of Marin is classified as a commercial bank, chartered in state, and not member of the Fed, subject to supervision by the FDIC.

When closing, Novato-based Bank of Marin would have approximately $4 billion in assets and would have operated 31 branches across 10 counties, making it one of the largest community banks based in northern California in terms of market capitalization. The Novato, Calif.-based bank said it had earnings of 69 cents a share. The company, which is owned by the bank, posted revenues of $34.5 million during that time. The banks board announced a 23-cents-per-share cash dividend on Jan. 23, to be paid Feb. 12.

The paymentee has paid its full joint judgment and served a contribution claim against Petitioner. From the district courts confirmation of the judges orders, only Banks appealed. On February 24, 1964, the Bankruptcy Referee determined that the petitioner bank, as well as the payee of the Bankrupts check, were responsible for Respondent.

The issue of relative rights and obligations of payee and bank should be resolved by a proceeding that involves both. In sum, it was inevitable that the plain language of the Bankruptcy Act makes the petitioner liable to the conservator for the cost of his payments on behalf of Seafood. Absent any withdrawal of its power or knowledge of bankruptcy, the bank cannot be held liable for resolving checks drawn prior to a depositors voluntary filing of an insolvency petition.

Petitioner, the bank, honored checks drawn before, but presented for payment after, a depositor filed a voluntary bankruptcy petition, and Petitioner had no knowledge of the bankruptcy proceedings.

The relation between banks and depositors is one between debtors and creditors, established by contract.

Offering commercial and personal banking, as well as asset management services, the Bank has a strong emphasis on supporting the communities they serve and lending to local businesses. American River Bank provides a broad array of products and services through 10 branches serving middle-sized, community-based businesses and individuals located in Sacramento, Amador, Sonoma, and Placer counties.

American River Bank is a Sacramento-based community bank serving Northern California since 1983. Join is expected to close in Q3-2021, and the bank had about $4.0 billion in assets upon closing, operating thirty-one branches across ten counties, including Alameda, Amador, Contra Costa, Marin, Napa, Placer, Sacramento, San Francisco, San Mateo, and Sonoma counties.

Given the reaction to the first wave of loans, the bank anticipates there will be few applicants for a second wave of loans administered through the U.S. Small Business Administration, said Tim Miles, chief operating officer. The Novato-based Bank of Marin said that reversing its $2.9 million commitment was due in large part to improvements in the expected rate of California unemployment in the coming four quarters, as well as to $40.2 million less money coming from the non-Paycheck Protection Program (PPP) loans.

Bank of Marins revenue for the first quarter included $ 2.9 million of the write-down in loan-to-value provisions, and $590,000 of write-downs of credit-loss provisions in non-financed loan obligations. The reduction in tax-equivalent net interest yields compared to the year-ago period was due principally to a higher percentage of Investment Securities in a larger balance sheet associated with a lower Loan-to-Deposit Ratio at Bank of Marin Bancorp, as well as to growth of other deposits, resulting in 74 basis points lower average yields.

Loans for which the Novato-based Bank of Marin stopped accumulating interest totaled $9.2 million, or 0.43 percent of its lending portfolio, at the end of Q1-2021, as opposed to non-accumulating loans, totaling $1.6 million, during Q1-20. The $148.0 million increase since Q4-2021 was due to payments on the banks own life insurance. Bank of Marin Bancorps strong cash position allowed it to shift $357.5 million in available-for-sale securities into the holding-to-maturity category as of March 1, 2022, which serves to partly insulate the rest of its total revenue and net assets from changes in the interest rates on $357.5 million in available-for-sale securities. Professional services expenses increased as a result of audit work performed in the first quarter of 2022 related both to auditing of year-end financial statements and to their recent acquisition.

Bank of Marin received a perfect customer satisfaction score because there were relatively few customer complaints filed with the Consumer Financial Protection Bureau (CFPB), the federally-backed agency that protects consumers. Management believes the presentation of operational results using financial measures other than GAAP provides investors with useful complementary information and makes it easier for them to analyze the performance of Bank of Marin Bancorp operations and compare operational results over reporting periods.

Last Updated on July 26, 2022

URL: https://log-in.me/marinnationalbancorp-lasvegas-unitedstates/