Simply explaining how to login to Bank Windhoek

Total Time: 2 minutes

Enter the website of Bank Windhoek

You will find the iBank (which is an abbreviation of internet banking) by logging on to their website https://www.bankwindhoek.com.na/Pages/default.aspx.

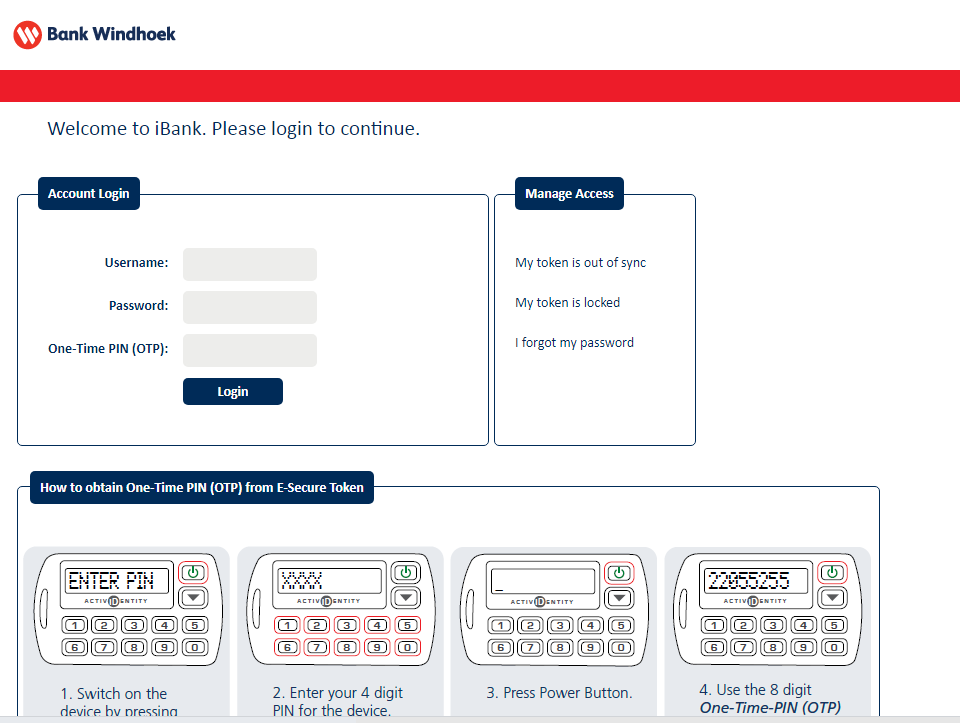

Locate the login box on the page

Click on iBank which is located on the right corner, upper side of the website. The log in box will appear once you click on iBank. Add your user name and password and optional one time pin if you want, then login.

If you forgot your password do the following

If you face any problem of locked account or you forgot your password, you can click on the options as the screenshot shows Also there is guidance on how to obtain one-time pin which is optional from E-scene token.

Frequently asked questions about Bank Windhoek

Can i register an account with Bank Windhoek?

Yes, It is very simple and easy to register any account or services that Bank Windhoek is offering.

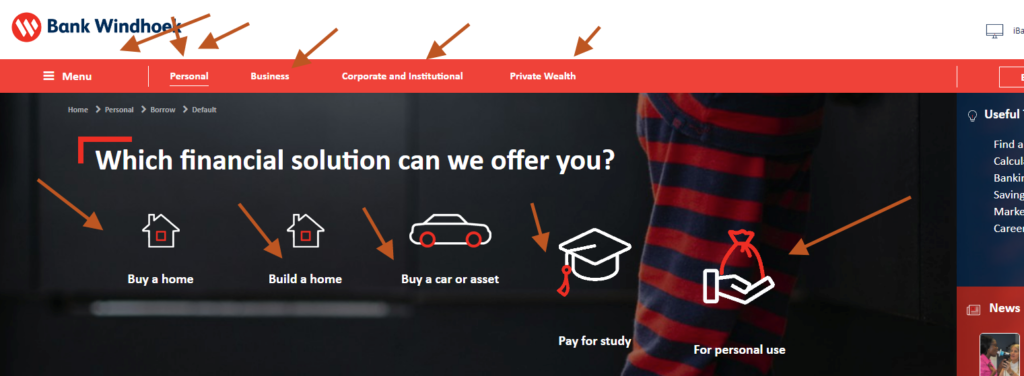

Just click on the Menu or Personal or Business or corporate institutional or Private wealth, as shown in the following screenshot, select the service you need whether to open a personal or business account or to apply for a loan, or to pay for study or to buy a car or to build a home or to buy a home etc., then go with the steps and process online.

It is very easy and simple and it will only take a few minutes to fill the form required for the applying process and submit it online.

Bank Windhoek Limited provides various banking products and services in Namibia.

The company’s personal banking products and services include transaction, cheque, and savings accounts. They offer personal loans, overdraft facility, home loans, and vehicle finance; short term, life, and travel insurance.

Its business and corporate banking products and services comprise international banking services, such as payment products, trade services, trade risk, and foreign currency accounts; treasury solutions; business financial solutions, including overdraft and business financing solutions, and business cheque accounts; bancassurance products comprising short and long term, travel, and long-term insurance; guarantees; investment, selekt, corporate, and commercial funds; and solutions for farmers.

The company also provides Internet banking services; and engages in micro lending, property investment, and payment clearing house activities.

The company was founded in 1982 and is headquartered in Windhoek, Namibia. Bank Windhoek Limited is a subsidiary of Capricorn Investment Group Limited.

Bank Windhoek Online Banking Login

Namibia (has a well-developed banking sector, which has state-of-the-art infrastructure, such as Internet and mobile phone banking. Bank Windhoek offers a broad range of Treasury services, including cash management and currency conversion services. Their international banking services consist of products for payment in foreign currencies, commercial financing, and accounts with foreign currencies. Bank Windhoek offerings include transactional, investment and credit products, and digital and electronic banking services.

In addition, there is an ATM with cash deposits available 24/7, as well as an IBANK Self Service Workstation to enable customers to access the banking products of IBANK as well as the Internet Banking services, all within a safe environment. Customers are able to conduct numerous transactions through its Internet Banking services, including payments to any Namibian or South African bank that is registered to Namclear or Bankserv, payments to third parties, transfers of funds to other domestic accounts, view and print statements on all linked accounts, halting cheque payments, and reversing transactions after they have been posted. According to Bank Windhoek, its iBank platform already comes with a notification service, in which clients are informed by SMS and/or email as they access their Internet banking accounts.

Bank Windhoek is planning to launch its iBank Internet Banking Service again in March 2015, in order to offer easy and convenient services for its customers while conducting Internet banking transactions. Displaying the caption, New Upgrade Alert,, a fictitious email informs recipients that due to new innovative technologies implemented by the Namibian-headquartered Bank Windhoek in 2013, firewall security has been implemented in order to ensure a minimal level of Internet banking services for its customers. Namibia headquartered Bank Windhoek will not ask customers to give out their confidential information via SMS or email either, added Toivo Mvula. Frankie Diergaardt, Electronic channels manager, explained Bank Windhoek would personally reach out to any affected customers using iBank, in order to walk them through the transition to the new iBank platform.

Ryan Gjeyser stressed that Bank Windhoeks mobile app allows customers to customize account names, they are also able to receive and manage notifications from Bank Windhoek about system alerts, transactions, and any other new updates. Other benefits to using the Bank Windhoek Mobile Banking App include a free on-demand electronic statement, immediate power purchase, and managing electronic fund transfers and card limits. At Bank Windhoek, online banking platforms remain free to use, with no separate charges for each transaction, as long as you maintain accounts which have a monthly package charge.

Customers are also expected to keep all of their everyday accounts with one bank in order to avoid paying for services that are not needed, or having payments bundled across banks. The customer needs only his/her DStv Smartcard number as reference for making manual payments to banks.

Bank fees refers to any mandatory charges imposed by financial institutions to customers personal and commercial accounts, used to establish, maintain, and perform transactions related to an account.

The guarantees are designed to specifically ensure that regional and international banks are covered for non-payment risks to a maximum extent of 100%, on commercial transactions initiated by domestic banks across several African countries. Finance minister Sosten Gwengwe confirmed the guarantees in a recent interview, adding that there are other commitments to finance with U.S. dollars the World Bank has made. The Finance Ministry has secured a $60 million financing commitment from the World Bank, to be used to restore electricity to the National Grid from various players in the electricity industry.

Members of the Financial Sector Development Group (Trade Finance Division) of the African Development Bank (AFDB) concluded a successful visit to Malawi to enhance engagement with the private sector and leading financial institutions. The team also held presentations to a select group of private sector officials, in order to increase awareness about key World Bank non-sovereign instruments, and introduce their recently launched Trade Finance Transaction Guarantee Instruments to the Malawian market. As the largest bank in Africa, we had an opportunity to take the lead in supporting Africas equitable energy transition. By accessing this site and the contents, you consent to the application of Namibian law to all matters between you and Bank of Namibia, and the exclusive jurisdiction of the courts of Namibia.

One of the key highlights for Bank Windhoek–winner of Namibias Bank of the Year in 2021–was the issue of the countrys first bond on sustainable development issues in June 2021. Namibias Third Largest Commercial Bank is the third largest of the seven commercial banks in Namibia, and reported profits of $30 million in the half-year ended December 31, 2014, a 12.8% increase from the previous period. Capricorn Investment Holdings holds 72% ownership in the countrys largest banks. WINDHOEK, July 2 (Reuters) – Namibias central bank blocked on Friday a bid by South African-owned ABSA ASAJ.J to take over the countrys biggest bank, citing concerns over the foreign domination of Namibias financial sector.

Just one month earlier, in May 2021, the bank launched a new mobile application offering greater convenience and security features including biometric access capabilities. The older app was actually better, mobile app does not even want easy to send wallets, transfers to other users…and worst of all, you cannot deposit money in ATMs either as it has same function off. Old App was better then update, mjshekupe was able to send my easy wallet on my account and send out the pins of the easy wallet, now I cannot.

Have you faced any problems when trying to login to Bank Windhoek?

Ask in the comments below. We will try our best to help you.

Last Updated on November 7, 2022

URL: https://log-in.me/bankwindhoek-windhoek-namibia/